GO-TO-MARKET SOFTWARE: PAST, PRESENT & FUTURE

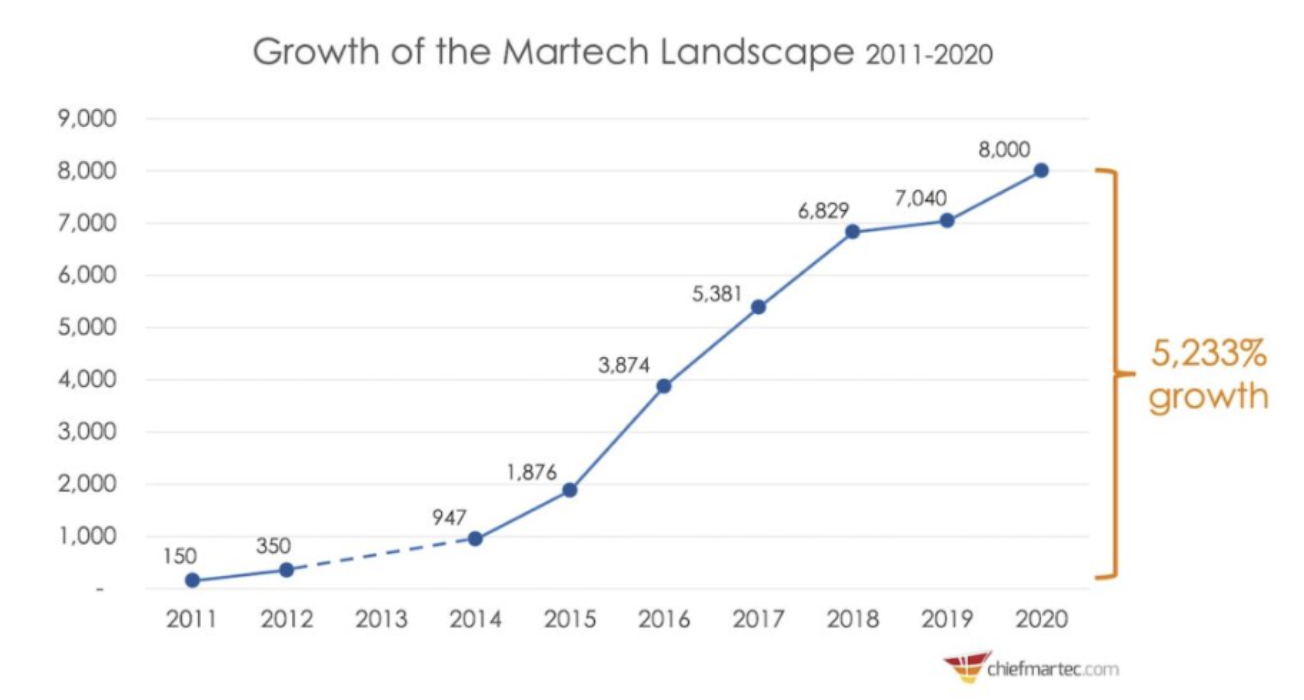

The surge in go-to-market software since 2011 has been remarkable: according to Chief Martec’s Marketing Technology Landscape – which tracks the number of sales and marketing software solutions available on the market – in 2020 there were 8,000 different vendors which is a 5233% increase from 2011. It is crucial to explain why this has happened if investors or entrepreneurs want to best position themselves for what is to come next and rise above the noise of a crowded space.

At Volition, we believe the key is to trace the industry’s most salient features – and shortcomings – which have defined its past and present states as we believe such analysis is a crucial ingredient to guiding an accurate diagnosis of the characteristics which will drive the success of future category-leading businesses.

Source: Chief Marketing Technologist: Marketing Technology Landscape Supergraphic 2020

The Rise of CRM and SaaS

During the 1990s – the early days of the internet – the most notable development in software for sales & marketing teams was the introduction of Customer Relationship Management (CRM) solutions. The promise of vendors like Salesforce – the original pioneer in CRM – was simple yet compelling: customers could access a digital central repository containing all the data relevant to their previous interactions with customers and eliminate the time-consuming, error-prone process of tracking such data with paper documentation.

The most noteworthy trend during the 2000s, on the other hand, was the proliferation of such systems powered by innovation in cloud technology. More specifically, the advent of the SaaS model dramatically democratized adoption of GTM solutions: for the first time, customers were able to utilize software over the internet rather than having to complete on-premise installations or pay for expensive custom software development.

As such, while the universe of applications beyond CRM that were available to forward-looking sellers certainly expanded during the decade, the biggest shift in the industry was a revolutionary delivery model that provided a much larger cohort of potential customers the opportunity to access existing solutions.

Present Day: Optimizing Customer Interactions & Employee Empowerment

In the last decade or so, however, the go-to-market technology landscape has fundamentally changed as a myriad of modern vendors have delivered value to sellers across a much broader range of use cases.

While there is certainly important innovation occurring in the legacy CRM industry (i.e. Creatio, a Volition portfolio company, which is upending the traditional CRM landscape vis-à-vis a low-code approach), there has been a vibrant explosion of solutions focused on more direct customer-facing use cases which aim to deliver tangible ROI to clients by optimizing the manner and breadth in which teams are able to interact with their audiences across a range of channels.

As such, the recent surge in GTM vendors has represented a dialectical step forward for the industry in that they have perpetuated software adoption across the broader S&M workflow ecosystem.

Just as contemporary vendors have widened the purposes for which teams utilize software in their GTM efforts, they have also more deeply penetrated organizations by magnifying the scope of addressable end users: while in the past it may have only been a select group of individuals within a S&M team that frequently used software, newer offerings are increasingly focused on boosting the productivity of every individual within an organization by offering intuitive, easily-navigable UI experiences that non-technical business employees (i.e. an SDR or AE) use as part of their daily workflow.

As a result, there has been a monumental shift in employees’ mentality towards software: more specifically, business users increasingly have the expectation that there will be software available to help make their job easier and their output higher.

At Volition, we are deep believers in these trends:

(1) the utilization of software to digitize and make more efficient high-leverage customer-facing processes which are directly tied to revenue-generation;

(2) the consumerization of solutions to better address the needs of employees throughout the organization and lower the barriers to entry for businesses – of any scale – to sell effectively online.

Indeed, both developments are quite apparent when you look at the current generation of successful GTM software providers.

First, let’s consider all the ways in which customer-facing workflows have been digitized by startups in recent years:

- Sales Enablement companies like SalesLoft or Outreach.io have streamlined workflows for SDRs by automating much of the outreach process

- Sales Intelligence data-providers like ZoomInfo have empowered sellers with an unprecedented level of data on potential prospects and thus enabled them to drive both a higher quantity and quality of leads

- Marketing Automation solutions like Hubspot or Marketo now give marketers the ability to strengthen their company’s brand via purpose-built campaign workflows & segmentation analysis. Automation vendors have also made it possible to adopt an omni-channel marketing approach that includes email, SMS, social media etc.

- AI chatbots like Tidio have begun to relieve the need for large customer service teams and are improving customer experience by shortening response time / enabling omni-channel interactions

- Content Management Systems like Wix or Webflow have enabled companies to establish and optimize their web presence much more easily

And yet, there remains considerable opportunity for startups to drive efficiencies in additional processes which are either entirely unaddressed by technology today – and thus represent attractive greenfield opportunities – or inadequately addressed by legacy solutions that are not equipped for the demands of modern selling.

Simultaneously, there have been many recent GTM startups whose success has been driven by their unwavering commitment to making the end-user more productive.

In fact, the strategy has become so ubiquitous that it has a name: “Product-Led-Growth”, or “PLG”, to describe companies which have adopted a bottoms-up, self-service distribution model in which individual end-users can adopt the solution at low-cost. In fact, GTM software may be the space where the PLG strategy has proven most effective when you consider the rise of businesses like Mailchimp, Productboard, HootSuite, and Gorgias.

The Road Ahead: Areas of Opportunity

For its part, COVID has accelerated this monumental shift in GTM software in that it has forced sales and marketing organizations to accelerate their adoption of technology outside of the “system of record” use case in two ways. First, the pandemic has increased the internet’s market share of all transactions (both B2B and B2C) dramatically, and in doing so, made the process of selling online more competitive.

In turn, S&M organizations have been pushed to adopt software to try to establish a competitive edge in how they interact with customers and prospects in a digital format. Second, executives are now placing an increased emphasis on employee productivity in a digital work environment and are looking for ways to make their personnel more efficient and engaged.

With these dynamics in mind, there are four sub-areas of GTM technology which we are particularly bullish on in the coming years and which we explore more deeply in the articles below:

- Vertical-specific Customer Engagement: solutions which are driving increased customer and prospect engagement and have a strong competitive advantage due to a single vertical-focus

- “Bottom-of-the-Funnel” Deal Process Management: vendors seeking to drive efficiencies for B2B sellers in late-stage funnel activities

- Sales Process Intelligence: solutions which help organizations gain visibility into why, or why not, they are driving pipeline conversion

- No-Code/Low-Code Vendors Enabling Marketing Personalization at Scale: solutions which enable non-technical sales & marketing professionals to generate personalized content in a scalable manner

To be clear, there are certainly pockets of opportunity that fall outside of these spaces which will produce huge winners in the category over the next decade, but it is our view that these sub-sectors currently appear particularly compelling when viewed in the context of the industry’s current state.

As such, Volition will continue to partner with companies throughout the GTM ecosystem in a laser-focused effort to help entrepreneurs build world-class technology businesses.