With Over $1.7B in AUM, Volition solidifies its position as a leading small-cap, technology growth equity fund.

BOSTON, MA – January 26, 2023 – Volition Capital, a Boston-based growth equity investment firm, today announced the closing of Volition Capital Fund V, L.P., with over $675 million in aggregate capital commitments, bringing its total AUM to over $1.7 billion. With its fifth and largest fund, the Volition team intends to continue bringing meaningful impact to a select group of high-growth, founder-owned businesses that aspire for greatness. Volition also intends to continue its history of active board involvement across its portfolio companies.

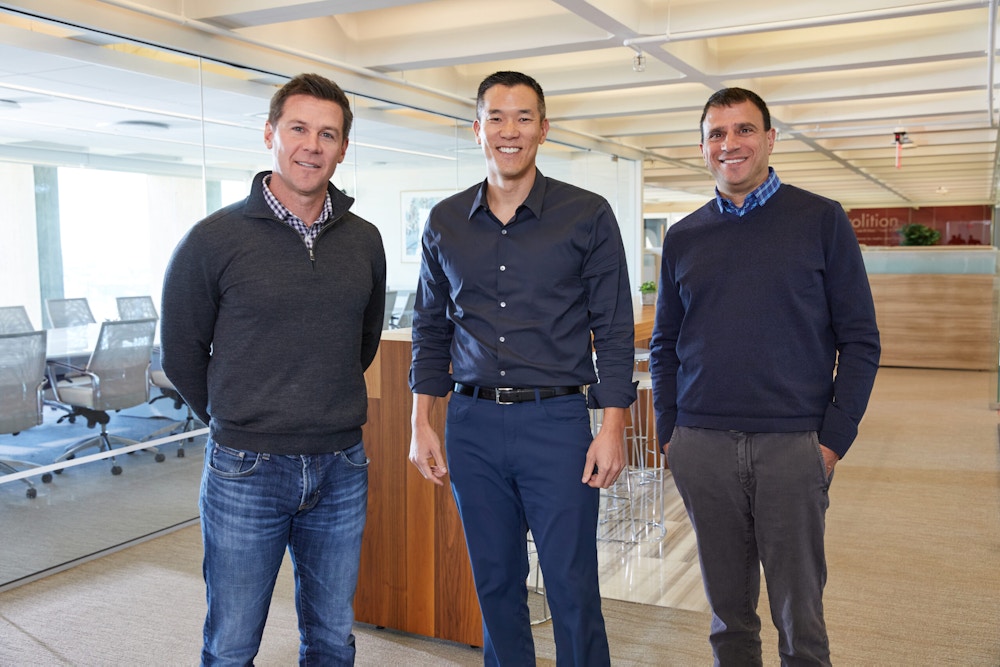

“At Volition, we strive to make a positive and meaningful impact on our portfolio companies and our limited partners,” said Roger Hurwitz, Managing Partner. “We achieve this through the discipline, focus, and consistency that has been the bedrock of our success as a leading growth equity firm with a successful track record of high-performing software and Internet companies.”

Since 2010, Volition has invested in and/or provided sub-advisory advice to more than 40 companies across the Software/SaaS, tech-enabled services, Internet applications, and consumer sectors. Current notable investments include Assent Compliance, Black Kite, Creatio, Doing Things, Tracelink, and US Mobile. Volition has also produced several notable exits, including Chewy, Connatix, JazzHR, GlobalTranz, and Securonix, among others. For a full summary of portfolio companies, visit https://www.volitioncapital.com/portfolio/.

“There’s nothing more fulfilling in this business than helping make a founder’s dream come true,” said Larry Cheng, Managing Partner at Volition. “With Fund V, we’ll have even more opportunity to provide founders with access to the network and support system needed to achieve their goals.”

“As we look ahead, we are confident that our long-held focus on high-growth, capital-efficient businesses with breakout potential will continue to stand the test of time – especially as we navigate the economic uncertainty of today,” said Sean Cantwell, Managing Partner. “We’re extremely grateful for the ongoing trust and support of our LPs who continue to believe in our value and vision and whose missions we are honored to further,” he added.

About Volition Capital

Volition Capital is a Boston-based growth equity firm that principally invests in high-growth, founder-owned companies across the software, Internet, and consumer sectors. Founded in 2010, Volition has over $1.7 billion in assets under management and has invested in and/or provided sub-advisory advice to more than 40 companies in the United States and Canada. The firm selectively partners with founders to help them achieve their fullest aspirations for their businesses. For more information, visit http://www.volitioncapital.com or follow us on Twitter @volitioncapital.