Welcome, 2022! The year that I believe will put the pandemic in the rear-view mirror but leave us playing catch up and digesting many changes that came with it. We are more comfortable with digital interactions, thoughtful about our work/life balance, considerate of health, and open to change. The pace of innovation across all categories has never felt faster, but here are a few trends that I am particularly interested in for 2022.

ADOPTION OF web3

Increased comfort with digital interactions has led to broader interest in web3 and the metaverse. Social media and the dominance of mobile devices in our lives blurred the lines between physical and digital. The notion that a party or vacation could be more broadly experienced via others on social media expanded as traditional workspaces and social interactions became facetime calls, zoom meetings and classes, ecommerce shopping, gaming and the like. These subtle bridges paved the way for Web3: cryptocurrencies, NFTs, DAOs and the Metaverse. We are entering 2022 with a changed mindset open to more extreme behavioral shifts and digital opportunities, but more bridges need to be built to introduce a broader set of consumers to this category.

- Virtual fashion via AR/VR and NFTs will increasingly appear as a part of social media posts and zoom calls demonstrating to consumers the fine line of physical and digital in this virtual age; with this, we will naturally become more comfortable with fit technology.

Companies to watch: DressX, BODS, Laws of Motion

- Infrastructure for Web3 must evolve to enable others to more easily and comfortably engage in this ecosystem – that shift is well underway but has a way to go for this to be an efficient and accessible ecosystem to try, enter, and build trust within it. Coinbase and OpenSea are early examples but much more work to be done.

Companies to watch: ImmutableX, Paysail

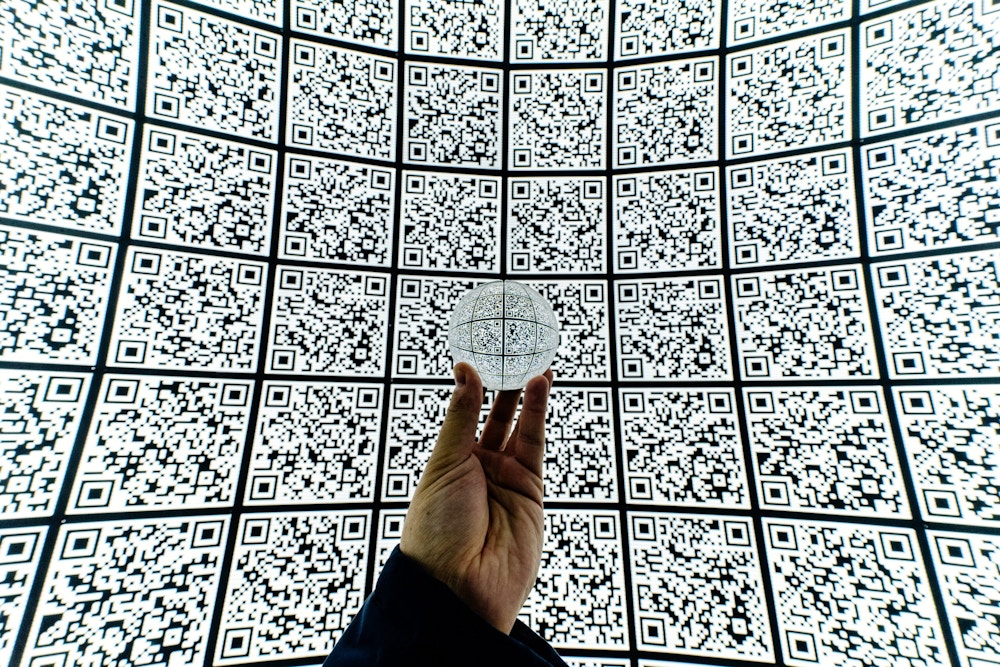

- Transparency and trust go hand in hand and is core to web3 – I see this as a trend that will increasingly apply to other categories stemming from the blockchain foundation of web3 and new expectations that without in-person interaction, building comfort requires an additional level of visibility and personal data security.

Marketing in the metaverse will be a category more brands will look to decode and adopt as the other digital channels have become less cost-effective.

Companies to watch: Admix

How we work

The European mentality of “work to live, not live to work” has caught hold more broadly via the exposure to work from home and a reminder of the need to prioritize health and happiness amidst the pandemic.

- Being more connected to home life and increasing work from home adds to the variety of task management necessitating more home-focused productivity tools.

Companies to watch: Hearth Display, Motion

- Spending categories for home enjoyment, hobbies, and pets will continue to grow.

Companies to watch: The Expert, Scenthound

- The pace of innovation and rich venture funding environment combined with increased flexibility of covid work has pushed forward a rise in entrepreneurship. The creator economy and more tools to enable no code site and product development will increase this trend.

HOW WE SHOP

Digital and omnichannel shopping is the norm with hints of experiential commerce reemerging.

- Increased application of video applications to various industries. Supergreat and ShopShops have continued to grow video commerce with more companies pushing into this frontier offering a way to combine the texture of physical shopping with the efficiency of digital commerce.

Companies to watch: HERO, Now With, Shop My Shelf

- Conversational commerce – since building Jetblack and a text-based tech stack for Walmart, I have been a believer that shopping over text (and eventually voice) can be an efficient tool. Tech is evolving to be good enough for more NLP (natural language processing) accuracy and automation. Alongside this, I am most encouraged by solutions that integrate a personal touch and feel beyond pure automation.

Companies to watch: Kickoff, Future Fit, Wizard,Wishi

- Democratization of luxury has been a theme in commerce as companies like Rent the Runway and Uber broadened the ability for everyday consumers to have a fractional share of luxury products and experiences. I believe that personal assistants and shoppers are the next frontier offering the ability to save time, build trust in recommendations that seem less automated, and result in better product matches for consumers.

- Convenience commerce has emerged on the scene in a big way and while I was skeptical, I go back to the three tradeoffs in the shopping ecosystem: speed, price, and quality. If you are optimizing for the first then businesses like GoPuff open up a behavioral shift – items like morning iced coffee in winter, ice cream normally delivered melted by grocery services and last-minute baking ingredients delivered in 30 minutes have quickly become a new category of shopping opportunities. We are more flexible on brand in these instances enabling these convenience shopping players to introduce new brands (and benefit from sponsorship opportunities) and private label brands.

Companies to watch: GoPuff, Duffl, Dumpling, The Rounds

- Our shopping behaviors continue to serve not only functional benefits, but also a way to self-brand and connect with communities and values. Social media has amplified this factor and NFTs take it to a new level. Sustainability continues to be the key social value that will permeate most all shopping interactions.

Companies to watch: Plastic Bank

- Supply chain issues connected to covid and the acceleration of digital have pushed innovation and shed a light on the large gap that still exists in efficiently servicing consumers in a digital age. We need ways to identify products closer to a consumer, inventory systems that enable us to do that, batching and routing across an increasingly disparate set of vendors that service or shopping needs.

- The hidden ways that digital shopping has taxed our time and attention require better solutions to support returns, personalization, and checkout. Customer service which has too quickly become a cost center is due for a rebirth as a helpful tool that can take customers through the last step of conversion, enhance a sale, increase the likelihood of repeat behavior and provide invaluable data for the business to evolve. Having a human touchpoint in a digital world makes all the difference and is especially important given the gaps and growing pains of our rapid digital evolution.

- Better utilization and cost savings in commodity businesses. As more consumers have cut the chord with various digital content offerings, we will continue to see this trend with adoption of MVNO’s in the wireless categories, skinny bundles for digital TV offerings, and considering how to apply this form of personalization to a broader variety of recurring costs.

Companies to watch: USMobile

How we live

- Predictions I made for 2021 around connected fitness and more proactive fitness have continued to evolve with more categories of reactive and proactive health adopting Telemedicine and increased comfort (and often a necessity) of using that channel. As more players emerge we will need more effective ways to manage this multitude of providers and our family’s medical data in an efficient and centralized way.

- The impact of covid on our children after two years of modified education has become clear ushering in better resources for families to support their children’s educational and mental wellbeing.

Companies to watch: Little Otter, SuperNow, EdSights

- The more digital our world becomes, the more we naturally look for ways to connect with one another and the energy derived from shared interests and common goals. Verticalization of Instagram, social discussion forums, web3 and even the brands we consume help us connect and identify but we still look for fresh ways to share our interests and engage with our “outer bubble,” colleagues, our children’s friends parents, Highschool friends, distant family members. The rapid rise in popularity of Wordle shows the excitement in finding shared areas of interest that are often simple and universally understood also pushing us to recall feelings of anticipation for the next day’s word grid that our instant gratification culture has gradually cast aside.

Companies to watch: Wordle, Shutterfly