Funds will support its continued growth, expansion of origination technologies and increased research and development

LoanLogics, a recognized leader in loan quality management and performance analytics technologies for the mortgage industry, has announced that it raised $10 million dollars in funding, led by Blue Cloud Ventures with participation from existing investors, including Volition Capital. LoanLogics plans to use the funds to fuel its continued growth, support its expansion into origination technologies, and for research and development to further advance its technology leadership.

Blue Cloud Ventures is a New York-based growth and late-stage co-investment fund that invests in highly successful, innovative and fast-growing cloud enterprise software companies. “Lenders continue to face more demands on their time from regulators and the stakes of non-compliance are greater than ever,” said Mir Arif, General Partner of Blue Cloud Ventures. “LoanLogics has developed a reputation for solutions that rely on sophisticated technology to satisfy regulatory issues, starting when the borrower applies for a mortgage until the mortgage is paid off,” said Rami Rahal, General Partner of Blue Cloud Ventures.

As part of the $10 million dollar raise, Volition Capital, a Boston-based growth equity firm that invests in high growth, market leading technology companies, has increased its investment in LoanLogics. “Regulators continue to focus much of their attention on establishing regulations designed to ensure loan quality,” said Roger Hurwitz, Managing Partner of Volition Capital. “Lenders require a way to stay compliant and that requires automation to process loans with the confidence that issues will be flagged and resolved well before the loan closes and across the entire loan life cycle.” Volition Capital has been an investor of LoanLogics’ since 2013.

“This latest investment in our company will help fund our continued expansion as a well-capitalized enterprise technology leader,” said Brian K. Fitzpatrick, President and CEO of LoanLogics. “We have emerged as the preeminent loan quality management and performance analytics technologies provider. We want to continue to move the industry forward with leading-edge, efficient technology that truly moves the needle forward with respect to reducing lender production costs.”

About LoanLogics

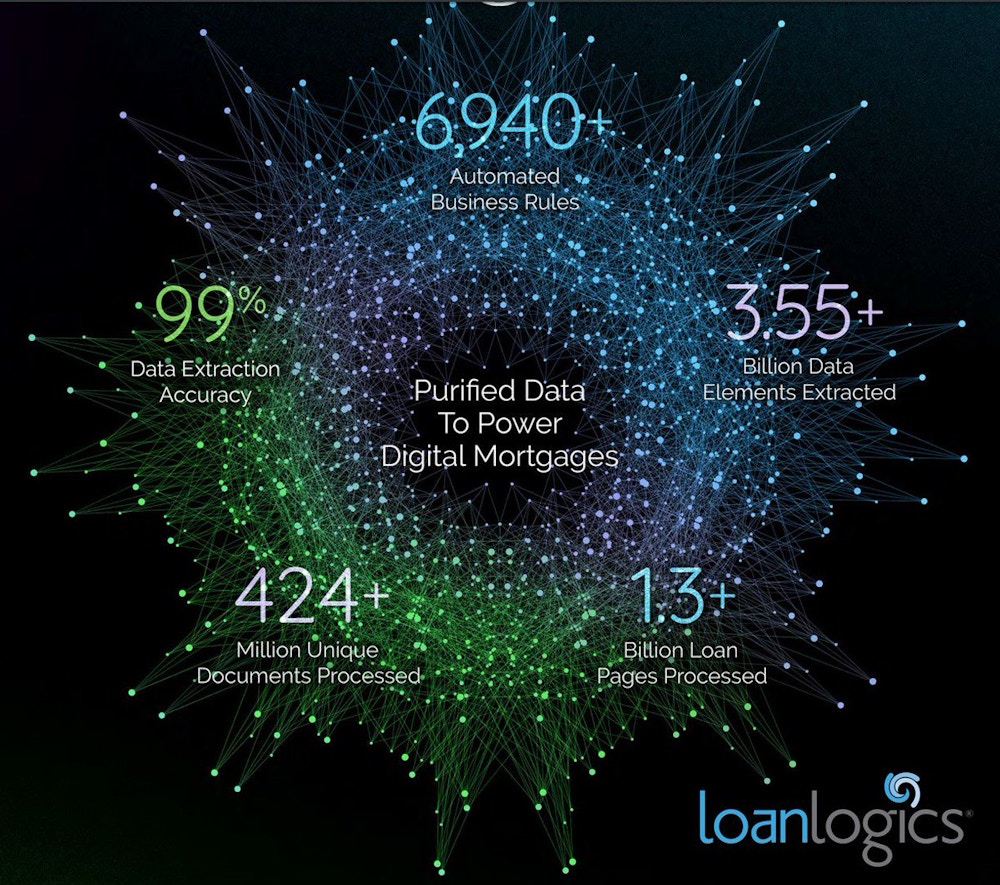

LoanLogics was founded eleven years ago to improve the transparency and accuracy of the mortgage process and improve the quality of loans. LoanLogics serves the needs of residential mortgage lenders, servicers, insurers, and investors that want to improve loan quality, performance and reliability throughout the loan lifecycle. It develops advanced solutions that help clients validate compliance, improve profitability, and manage risk during the manufacture, sale and servicing of loan assets. Achieving these goals was the motivation in the development of the industry’s first Enterprise Loan Quality and Performance Analytics Platform. To learn more, visit www.loanlogics.com.