by Andy Flaster

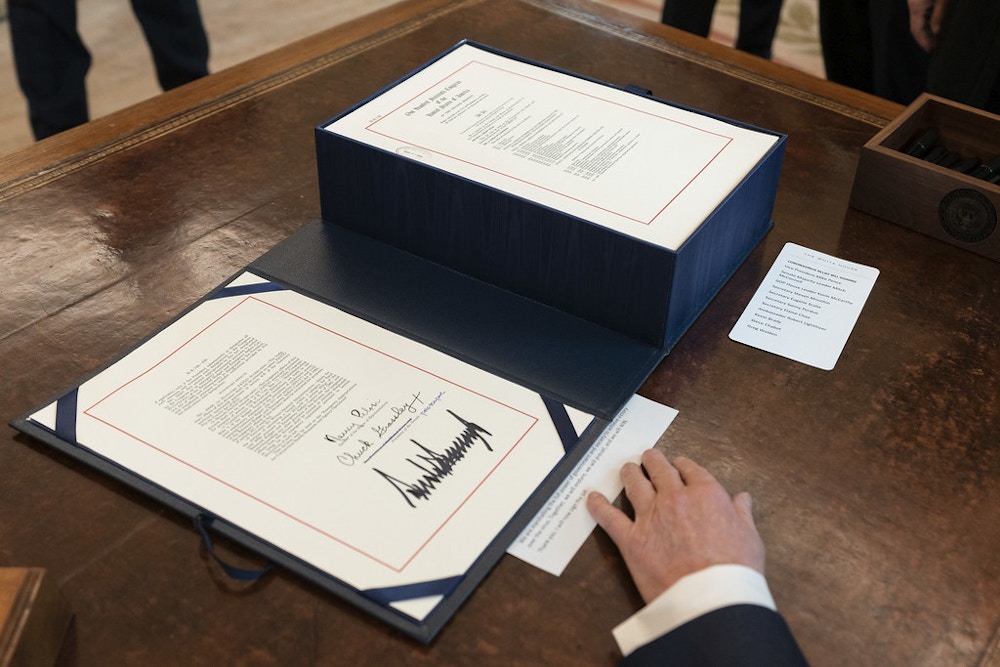

On March 27, the Coronavirus Aid, Relief, and Economic Security Act or CARES Act, a $2.2 trillion federal program, was signed into law by President Trump. One of the Act’s major provisions is a $349 billion Paycheck Protection Program (PPP), intended to aid small businesses by providing them with loans. With the scale of this legislation and the speed with which it passed Congress, it has taken some time for clarity to emerge about some of its specifics. It’s important to note that the government’s guidance may change over time.

By the end of the day on Wednesday, April 15, the SBA had exhausted its full $349B of authorized PPP loans. Congress is already talking about expanding the amount available for the Paycheck Protection Program (“PPP”) loans. A new program, the Main Street Lending Facility, has been announced by the Fed to accomplish this. Additionally, the SBA and Department of the Treasury have provided some more guidance on the PPP loans and other elements of the CARES Act.

On April 9th, the Federal Reserve announced that it would provide up to $2.3T in loans to support the US economy (link here). The most relevant portion of this initiative for venture-backed companies that have positive EBITDA is a $600B initiative entitled the Main Street Lending Facility (“MSLF”). The terms of MSLF, which is in addition to the Paycheck Protection Program, provides funds for banks to lend to companies that have under 10,000 employees and $2.5B of revenues as currently authorized.

It’s important to note that Volition Capital is not offering legal advice; the information provided is meant to help your understanding of the key issues so you can determine next steps. As always, consult with your legal counsel, who will be more familiar with your specific situation and can advise you on each of these issues, the relevant laws as they may apply to your company, and ultimately your decision on whether you may be eligible for (i) a PPP loan, should additional funds be appropriated for the program by Congress, (ii) a MSLF loan or (iii) the Payroll Tax Deferral under the CARES Act.

The following is a list of resources we’ve shared internally and with our portfolio companies that’s intended to provide further context on the Act and its provisions. As information is constantly evolving, we will keep this list updated with the latest resources relevant to venture-backed companies:

Helpful Links and Resources

CARES Act and PPP

- For general information about the SBA Paycheck Protection Program, refer to the dedicated webpage. The application form can be found here.

- To help determine if your organization is eligible for PPP funds and will be affiliated with your investors, consult the SBA’s Affiliation Rules Applicable to PPP.

- To better understand the specific implications for venture-backed companies, The NVCA has a running page devoted to the CARES Act. And for specific guidance around affiliation rules and the application process, see The NVCA’s guidelines.

- For insight into how to use proceeds from PPP, the terms of the loans, details on the forgiveness provisions, and how to calculate the amount of the loan, the Treasury released guidelines in the form of a fact sheet.

- For further clarification on the Deferral of Employer Social Security Payroll Tax Payments (a portion of the CARES Act), and how it interacts with the PPP loan program, the IRS released this Payroll Tax Deferral FAQ. NOTE: a company is eligible for the deferral of its employer’s share of FICA payments incurred for the rest of the year, whether or not the company has applied for or taken out a PPP loan, so long as the loan has not yet been forgiven under the PPP rules.

- To better understand the legal risks that come with taking government funds, Goodwin has published, “Enforcement Risks for Recipients of US CARES Act and other Federal Funds.”

- Several law firms have published informative materials on these issues. The best we’ve seen so far on the CARES Act are:

- Proskauer Rose published the CARES Act Expansion of SBA Loan Programs for Small Businesses Summary and FAQ for Private Fund Sponsors. More content is updated on its Insights page.

- Choate provides a helpful summary and FAQ, here.

- Cooley published, “SBA Programs under the CARES Act: Affiliation Interim Final Rules and Guidance.” link, here. More content is updated on its Insights page.

- Gunderson Dettmer’s provides content on its Client News page.

- Debevoise and Plimpton published a comprehensive resource center.

Main Street Lending Facility

- For more information on the MSLF, the Fed released a term sheet on April 9th.

- For more detail on the program, here is a useful piece from Cooley.

- Additionally, The NVCA has provided a comment letter to the Fed urging changes in the MSLF program to enable venture-backed companies to participate in the lending program.

Be well and stay safe.

ANDY FLASTER

Managing Partner, COO

Prior to the Volition spinout, Andy was the CFO of Fidelity Ventures for 10 years, focused primarily on finance and investment support. Previously, he was the VP Finance at Thomas H. Lee Partners. Andy began his career in auditing and consulting at Coopers & Lybrand.

Andy earned a Master’s Degree in Finance from Boston College and a BS in Economics from the Wharton School of the University of Pennsylvania.