Lessons Learned from the FBA Consolidation Space

Thrasio was the first mover to recognize the market opportunity to aggregate FBA sellers. The founding team recognized a market opportunity that was highly fragmented with cash productive assets, lacking liquidity options in a market experiencing significant secular growth.

The summation of these attributes was the ability to acquire assets at below-market multiples of profitability. With the ability to scale earnings and profitability, there was a multiple arbitrage opportunity, where the sum of the parts commanded a higher valuation multiple than the individual underlying assets.

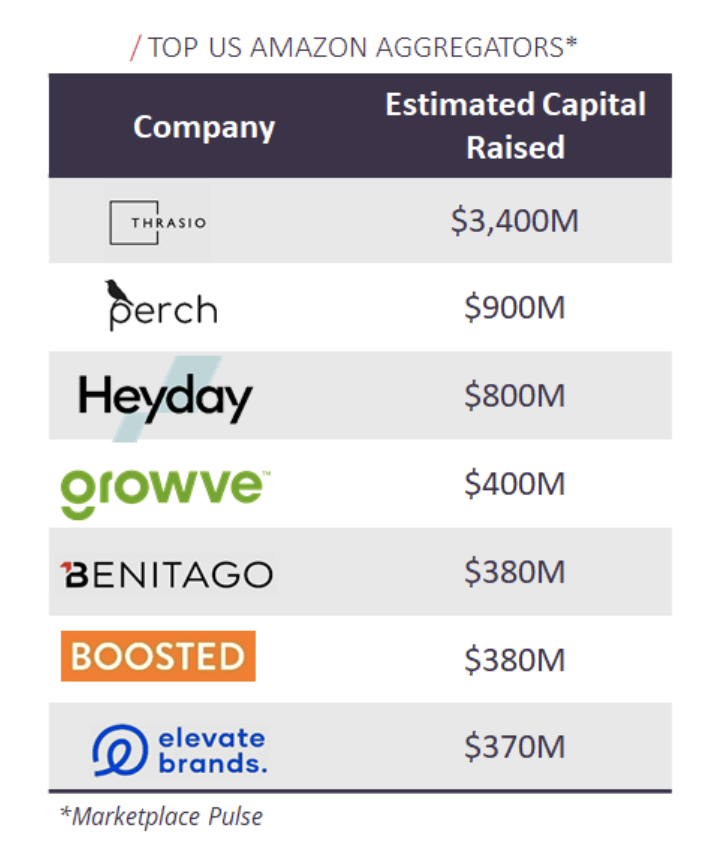

Thrasio received its seed funding of ~$6M in April of 2019 to execute this aggregation and professionalization strategy. Flash forward less than three years later, and there has been $14B+ in funding across 50+ Amazon aggregators.

How did this happen?

Many startups tracked the early success of Thrasio, as the business set a new US record in July of 2020 as the fastest profitable startup to reach unicorn status. ¹

The critical word in this press release is profitable. It was unprecedented to see a business scaling ~100% annually reach $300M in Pro-forma revenue in just two years AND be EBITDA profitable.

Often, profitability for startups means sacrificing hyper-growth, yet Thrasio was able to sustain both. This growth and profitability attracted many other entrepreneurs to the market to try to achieve unicorn status in record time leading to 50+ other startups raising nearly $14B in capital to aggregate FBA sellers.

Impacts of a Crowded FBA Aggregation Market

A highly funded aggregation market increased acquisition multiples which materially impacted asset payback periods. As more funding entered the market, there was a deterioration of marketing efficiency or ROAS (Return On Advertising Spend), with a new wave of consolidators bidding on competitive keywords for search optimization. This resulted in asset payback periods shifting from ~2 years to ~5+ years. Aggregators had to evolve their business models as KPIs deteriorated. Volition invested in Dragonfly, that saw opportunities to launch new brands as a compliment to their acquisition strategy where there were gaps in the market. Others saw a chance to enter new markets outside the US that had less competition, such as India. The market continuously evolves, and winners will still emerge with new strategies before competitors follow their lead. Ultimately, the aggregators will likely be aggregated as the largest brands look to capitalize on their size and scale.Lessons Learned

While reflecting on the FBA aggregation model, it became clear that low barriers to entry led to this meteoric wave of funding across dozens of companies. As entrepreneurs think about aggregation categories and other startups in general, it is important to either be a first mover or have some barriers to entry.

These barriers to entry could be a technological or software advantage, industry knowledge, or unique deal flow sources. This will create a larger greenfield opportunity and prevent the market from seeing as much competition.