By Sean Cantwell & Jake Wasserman

A few months ago, we wrote about how companies must balance both growth and profitability instead of chasing growth at all costs. This tradeoff has recently come into greater focus as fast growth has become more difficult to maintain and outside capital more difficult to rely on. Although recurring revenue streams make SaaS companies better equipped to weather recessionary environments, like any other company, the COVID-19 pandemic has forced them to navigate a new reality. Amidst these unprecedented economic times, we wanted to share a few of the themes and metrics that we are focused on as we evaluate SaaS businesses today.

1) Net New ARR / Cash Burn

In a period of market expansion, growing quickly is more attainable and capital is cheaper, so it makes sense to invest heavily (i.e. burn cash) in growth. As growth prospects change and it becomes more difficult to add new logos, companies are forced to recalibrate burn. The phrase “capital efficient” is often used, but how do we really measure it?

One way is to look at Net New ARR / Cash Burn. The ratio gives insight into the speed a company is burning cash and the sustainability of that burn. A company with a ratio of greater than 1x should feel good about their burn rate and balance sheet dynamics. For companies with a ratio below 1x, they may eventually need to raise a round of outside capital or change spending relative to growth expectations.

2) Product Usage

Companies across the board are looking to save money by ending subscriptions to “nice-to-have” products and only renewing the “need-to-have.” One way to determine the amount your customers rely on your product is to simply look at how often they use it. If customers use it every day, your product is more likely to be viewed as critical and less likely to be cut from the budget. It may make sense to reach out to customers that use the product less frequently to better understand their situation, proactively addressing potential churn.

3) Customer Satisfaction

Another leading indicator of potential churn is customer satisfaction. Regardless of current retention dynamics, poor customer satisfaction scores call for a greater focus on current customers, whether it be tweaking the product to make it more user friendly or investing more in a customer success operation.

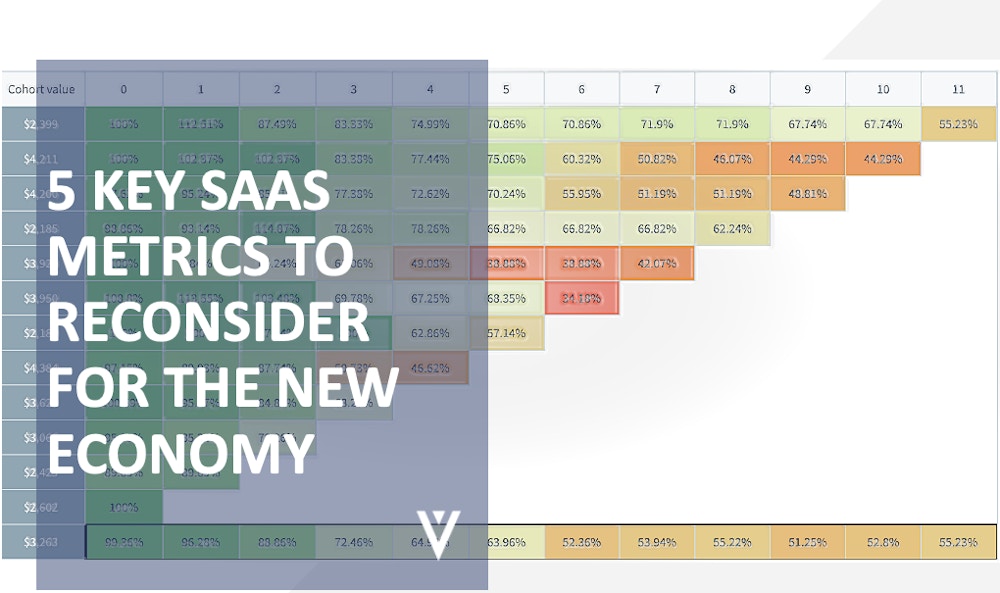

4) Gross Retention and Net Retention

Faced with increased difficulty in adding new logos, stabilizing the existing customer base becomes especially critical. High gross retention indicates a company has a solid base of customers providing a consistent revenue stream. High net retention also factors in the ability to up-sell and cross-sell, which represents an opportunity to add revenue without adding new customers. While some churn may be inevitable from companies that go out of business or aggressively cut costs, SaaS companies should look to spend resources towards shoring up the existing base and maintaining retention dynamics to the extent possible.

5) Collections

As the balance sheet comes back into focus, managing cash dynamics and the cash conversion cycle is becoming increasingly important. Collections may be a metric worth monitoring as your customers face unprecedented financial stress. If Accounts Receivables have escalated above historical levels, consider what this means for your ability to spend over the long-term. If some customers are no longer paying your fee, managing bad debt may be a new area that requires your attention.

Benchmarking Success During Recovery

As Volition Portfolio company Cortera noted in reference to its Cortera COVID-19 Economic Impact Tracker (CEIT), recovery over the next few months looks to be industry and state-specific in somewhat random vectors. The 5 themes and metrics above should help SaaS companies better understand their position as they evaluate the specific market dynamics affecting their customers and revenue streams. We are in an economy where both the nature of work and the workforce are in flux, so both SaaS company founders and investors will need to think differently about how they benchmark success.

Sign up for our mailing list to get Volition Viewpoints in your inbox:

Meet the Author:

SEAN CANTWELL

Managing Partner

Sean Cantwell is a managing partner and member of the founding team at Volition Capital. He focuses primarily on companies in the Software and Tech-Enabled Services sectors.

Connect with Sean:

JAKE WASSERMAN

Analyst

Jake joined Volition in 2020 and is responsible for sourcing and providing due diligence on new investment opportunities within growth-stage software and tech-enabled service businesses.

Connect with Jake:

617-830-2110

Jacob@volitioncapital.com

LinkedIn