Good Morning!

In today’s edition of the Volition View, we look forward to sharing a thought piece from Volition Vice President, Claude de Jocas, on one of our favorite in-house metrics when it comes to looking at businesses: CPAAS.

Inside:

- Deep Dive: Contribution Profit After Advertising Spend (CPAAS)

- Portfolio Media: Creatio Launches 8.1 Quantum

- Market Perspective: How Long Do Employees Stay at Startups For?

- Portfolio News: Zenarate, Pramata, SUPER73, Inc.

- Portfolio Fun: Vik White x Creatio

Let’s Dive In!

DEEP DIVE

CPAAS: A Core Metric at Volition

Introduction

In today’s macro-environment, the landscape that founders have to navigate through is complex, to say the least. While investors are demanding a drive toward profitability, the reality is that continuing to invest in growth responsibly is often the correct course of action. The question then becomes, what metrics should be used to analyze the health of a business while continuing to invest in growth? Below, I look forward to sharing a metric that has become standard at Volition – CPAAS.

CPAAS

Contribution Profit After Advertising Spend (CPAAS) is the profit remaining after deducting advertising spend from contribution margin. Contribution margin is defined as revenue minus variable costs (costs associated with the production and fulfillment of an individual unit).

Notably, contribution margin excludes fixed costs (equipment rent, executive salaries, etc.), enabling companies and investors to look at the unit-level profitability of a business.

One of the shortcomings of contribution margin is that it does not take into account marketing expenses, as this historically is viewed as a fixed cost. At Volition, however, we view direct customer acquisition expenses as a critical component of the unit economics of a business. CPAAS allows us to go one step further by subtracting ad spend from contribution margin, thereby recategorizing certain aspects of marketing spend (typically direct customer acquisition expenses) as a variable cost.

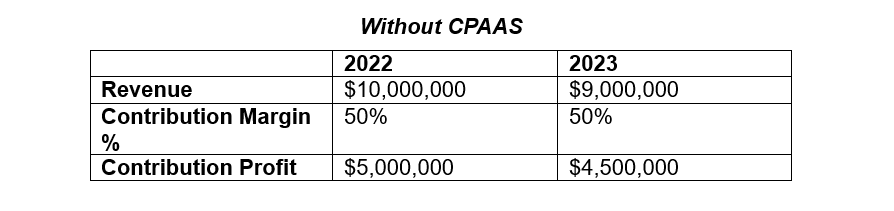

Here is a quick visual displaying the difference between contribution margin and CPAAS.

- Contribution Margin = Revenue – Variable Costs

- CPAAS = Revenue – Variable Costs – Advertising Spend

Why CPAAS?

Often when businesses attempt a pivot to profitability, it can lead to flat or declining revenues. While this transition is occurring, companies still need to be accountable to their board and investors and show progress. Founders often lack the metrics to demonstrate the improvements being made in terms of revenue efficiency. CPAAS is a way to illustrate to stakeholders that even while revenue might be down, the underlying fundamentals of the business can be improving quite dramatically – even if the business has yet to achieve bottom-line, or EBITDA, profit.

Example

Company A is a direct-to-consumer e-commerce company that was previously operating with a “grow at all costs” mentality. Recently, management and the board aligned on a more sustainable growth strategy, one that balances growth and profitability. As a result, the Company pulled back meaningfully on total advertising spend, focusing only on its most efficient acquisition channels, which resulted in a 10% year-over-year decline in revenue.

Let’s take a look at two ways Company A could present its financials: Without CPAAS and with CPAAS.

The table above shows that Company A’s revenue was down 10% YoY, contribution margin was neutral YoY, and contribution profit was also down 10% YoY. This is likely to be a difficult conversation for management to navigate with their board, as both revenue and profitability, defined here as contribution profit (revenues – variable costs), have declined. Now let’s take a look at an alternative way Company A could present its financials including advertising spend:

By including advertising spend as a component of CPAAS profitability, the improved efficiency of the revenue is highlighted. Although Company A’s revenue decreased by 10% YoY, the advertising spend decreasing by 80% leading to a 150% increase in CPAAS and overall a CPAAS positive business. Furthermore, it becomes apparent that revenues in 2022 were unprofitable on a CPAAS basis, and that the strategy shift in 2023 has set the company on a more sustainable path.

These two charts display that a simple reclassification of advertising spend into a variable cost can greatly change how you position your company’s financial trajectory. By integrating the CPAAS formula as part of your financial reporting, this can help you, your executive team, and board better understand the unit economics and progress of your business, particularly when embarking on a pivot towards profitability.

Talk soon,

Claude

VOLITION MEDIA

Creatio Launches 8.1 Quantum

Last week, Creatio announced the launch of a major new release, 8.1 Quantum. 8.1 Quantum includes several major innovations like new composable apps for CRM, integration with generative AI, a full-blown no-code governance application, and more.

Along with the launch, Creatio shared a digital show featuring bestselling author, Seth Godin, and a keynote on the future of the business by Katherine Kostereva, CEO of Creatio. Make sure to check out the show below:

Link: Click Here

MARKET PERSPECTIVE

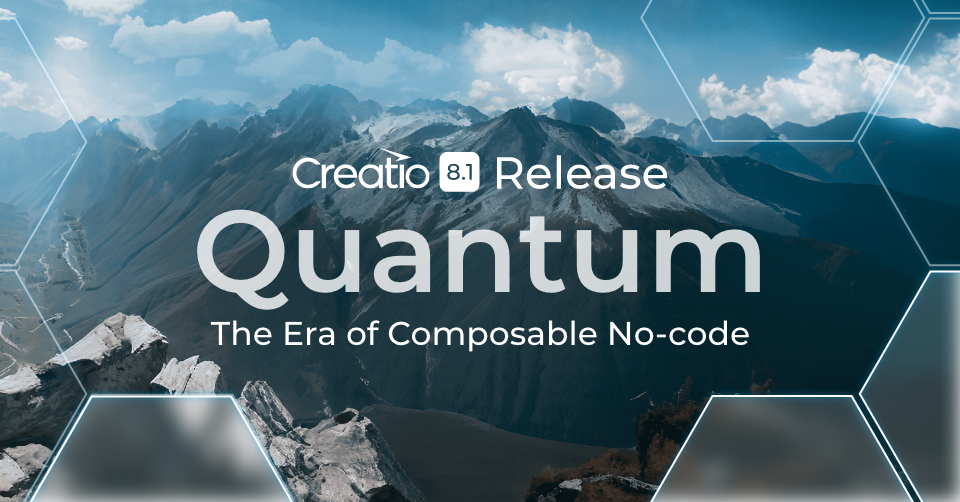

How Long Do Employees Stay at Startups For?

- 21% of employees stay at startups for less than one year

- 9% of employees stay at startups for more than 4 years

- 47% of employees at $500M+ companies stay for 1-2 years vs. 34% at startups at a valuation between $10M-$25M

PORTFOLIO NEWS

Zenarate, Pramata, Super73

- Zenarate: Developing Top-Performing Contact Center Agents Through Microlearning (Forbes.com)

- Pramata:The Power Of Generative AI (Webinar)

- Super73: This e-bike for 4-year-olds can do 15 miles an hour, costs $1,300 – and sold out in a month (Business Insider)

PORTFOLIO FUN

Vik White x Creatio

Along with the launch of Quantum 8.1, Creatio partnered with influencer Vik White to create a customized “no-code” dance performance. Make sure to check out the dance here

Thanks for the read! We would love to hear what you think, so feel free to send us an email if you would like to chat.

-The Volition Team

DISCLAIMER

This information is provided for general informational purposes only. Under no circumstances should this information be used in connection with or be considered an offer, solicitation of an offer, or a recommendation to purchase or sell, any securities, nor does any such material constitute investment, legal, accounting or tax advice or an endorsement with respect to any investment strategy or company. This information may include forward-looking statements. Volition Capital LLC (“Volition,” “we,” or “us”) can give no assurance that such expectations will prove to be correct. Past performance is not indicative of any specific investment or future results. Any specific companies listed or discussed are for illustrative purposes only, and do not represent any or all companies purchased, sold or recommended or an investment recommendation or offer to provide investment advisory services. Views regarding the economy, securities markets or other specialized areas are not guaranteed to be accurate. Volition does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any of this information, and Volition takes no responsibility therefor. Volition has no obligation to update, modify or amend any such information or to notify you in the event that any information, opinion, projection, forecast or estimate changes or subsequently becomes inaccurate. The views expressed herein are those of the individuals quoted or named and are not the views of Volition Capital LLC or its affiliates. This information is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Volition.