INORGANIC GROWTH IS UNDERVALUED RELATIVE TO ORGANIC GROWTH

This has always been a core thesis at Volition. There is opportunity to rapidly create equity value, potentially faster than organic growth, through acquisitions. Organic growth by nature has limitations on growth rates based on diminishing returns of marketing spend exceeding a certain threshold.

With inorganic growth, there are no limitations to growth based on the absolute dollars added to the top line revenue. The tradeoff is obviously the cost to acquire a business. However, there are many scenarios where the sum of the acquisitions more than pays for the individual asset costs. At Volition we have been pursuing and evolving our approach to acquisitions over the past 10+ years.

Seam #1: Internet-enablement of offline transactions

Volition’s first evolution of an inorganic growth strategy was moving offline transactions online. This was done through IT Service providers with Mindshift (Acquired by Best Buy), freight brokerages with GlobalTranz (Acquired by the Jordan Company), insurance sales enablement with Ipipeline (Acquired by Thoma Bravo), and waste hauling service with RTS.

In all these investments, inorganic growth was complimentary to the organic growth strategy. Typically, over the hold period there was a realization that an M&A strategy could accelerate growth, increase market share, or expand TAM.

The lessons learned from our first iteration of inorganic growth as complimentary has informed our investments decisions in recent portfolio companies. For example, Medly is a full-service, digital pharmacy that offers free same-day prescription delivery. Acquisitions are core to Medly’s hyper growth strategy, whereby acquiring pharmacies and their licenses allows for faster geographic expansion. There are still many markets that are ripe for internet-enablement, and we believe taking an inorganic strategy will be essential to gaining market share.

Seam #2: Creator economy consolidation

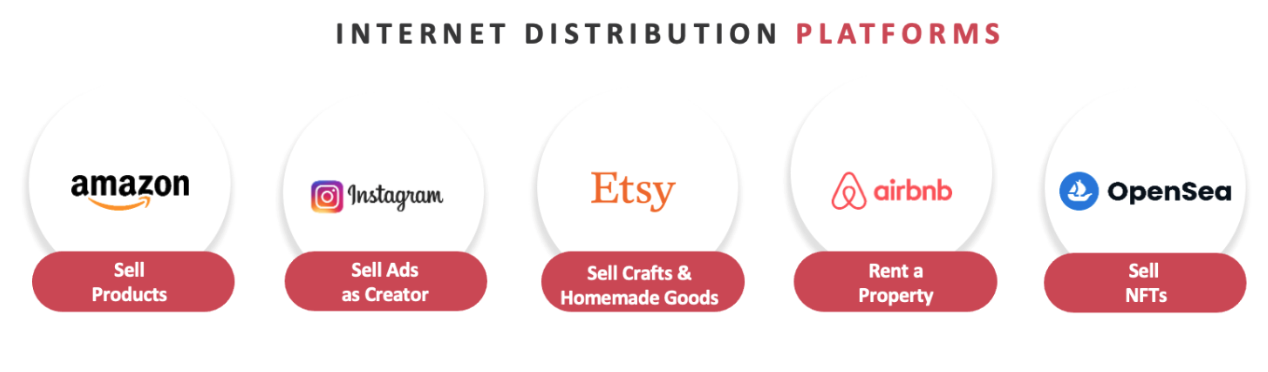

At Volition, we are seeing a wide variety of internet platforms that enable entrepreneurs to easily create profitable businesses. These businesses can be either a side-hustle or full-time career but are all powered by the rise of many internet distribution platforms.

Examples of these distribution platforms include Amazon providing the infrastructure for third party sellers through FBA, Instagram providing an audience for influencers to sell ads, Etsy enabling the sale of crafts and homemade goods, Airbnb providing a marketplace for property rentals, or OpenSea enabling the sale of NFTs.

Internet platforms provide out-of-the-box enterprise infrastructure and immediate scaled distribution. One of the most difficult aspects of building an online business is acquiring customers. Many D2C businesses may have a strong product offering but lack the ability to efficiently market their products. Internet platforms provide inherent consumer demand to solve this challenge.

Of course, there is still competition within these platforms but most of the time there are easy-to-use advertising features. The critical aspect for scalability is that the platforms do the advertising to bring initial consumer demand, eliminating that most difficult part of customer acquisition. We believe there are over 4 million new digitally-enabled entrepreneurs across these internet platforms with cash generative businesses without an exit strategy.

At Volition we believe there is an opportunity to be the financial partner to provide these entrepreneurs with a liquidity opportunity. We have seen these liquidity events provide financial freedom to digital entrepreneurs and allow them to pay off loans, start new businesses, or even retire.

Our focus is consolidating these digital platform businesses into a single entity. While the market size of each product or service alone may be limiting, the addressable opportunity expands with each acquisition. By consolidating these cash generative businesses there are back-office efficiencies gained and the ability to invest in more products or services while increasing the marketing budget to drive revenue growth.

These learnings have led to investments in Dragonfly, a consolidator of Amazon third-party sellers, and Doing Things Media, a consolidator of social media publishers. There are a growing number of internet platforms that have these attributes, and we are excited to be the partner to grow the consolidation platform while providing a liquidity event for digital platform entrepreneurs.