Good Morning!

We hope everyone had a great 4th of July! We’re excited to welcome you back with a special edition of The Volition View featuring our “Mid-Level Roundtable.”

In case you missed it, make sure to check out the last edition of The Volition View where we shared an interview with Zenarate CEO Brian Tuite and discussed our recent investment in the company.

Inside:

- Deep Dive: Mid-Level Roundtable

- Market Perspective: A Valuation Bounce Back?

- Must-Read Resources: Commoditizing Market, Cyber Security, Meta’s Threads

- Portfolio News: Creatio, hackajob, SnapAttack, Super73

- Portfolio Fun: Doing Things Media Launches “The Audio Game”

Let’s Dive In!

Deep Dive

Volition Capital’s Mid-Level Roundtable

Introduction

With the first half of the year now officially in the books, it’s the perfect time to connect with our talented Mid-Level team and hear their thoughts on the market. Which sectors are our Mid-Levels excited about for the second half of the year? What advice do they have for founders? Don’t miss out on their answers to these questions and more as we below present a special edition of The Volition View.

Mid-Level Roundtable

1. What sectors or areas currently excite you from an investment perspective? Where do you think the best opportunities currently lie?

Claude De Jocas: I am particularly interested in the rise of what we are calling “cross-border solutions.” Remote work is not going away, companies are more serious about cross-border employment, and ones that are looking to get leaner are offshoring employment more often.

Along with these global organizations comes a plethora of different payment, compliance, tax, and regulatory considerations. There will be serious opportunities for ventures that can provide unique solutions to companies that are moving towards a more decentralized, multinational workforce.

I am also watching the consumer application side of generative AI closely. I believe that generative AI will help democratize a whole swath of consumer services. One of my favorite examples includes thinking about what generative AI can mean to wealth management and consumer financial products. Leveraging AI, we will see wealth managers be able to scale themselves more efficiently, take on far more clients, and empower families with tools and services that were once reserved only for the highest net-worth individuals.

Melanie Jordan: Expanding on Claude’s point, in the AI space, I am excited to see how AI can lead to greater human enablement – an area that we recently invested in with Zenarate’s $15 million Series A. Specifically, AI will be able to standardize and create best-in-practice tools and processes for sectors with repeated certification requirements like healthcare in nursing or finance professionals with their CPA and CFA certifications.

Speaking of CPAs and CFAs, another area I am closely monitoring is the “Office of the CFO.” The tools and technologies that CFOs use have not kept up with other analytics and forecasting resources. Over 40% of B2B payments are still executed through checks, and accounts payable and receivables systems continue to be managed using outdated technologies like Microsoft Excel and QuickBooks.

I believe the growing emphasis on profitability and cash conservation will make having the best technologies a must for finance executives. Another great stat to support this trend is that 93% of US firms with $25 million in revenue or more are currently integrating new technologies for accounting operations. CFOs are not satisfied with the solutions they currently have and are looking for better alternatives.

2. What is something you will be watching closely in the back half of the year and into ’24?

Jim Ferry: Over the next several months, we will see many companies facing balloon payments on their debt without the means to finance them. In more favorable times, banks often only required interest payments on the debt, postponing the payment of any principal until the maturity date when a lump sum balloon payment would be due.

These companies who took on the debt likely intended to service the loan through refinancing, however, the debt markets have dried up considerably due to a rise in interest rates, recessionary fears, and recent events in the banking sector.

I am curious to see how companies will look to finance these payments and how many will ultimately be unable to do so, resulting in many companies shutting down.

Dave Gordon: What I will be watching closely is how long the current hype cycle we’re in around generative AI lasts. Will we see actual utility from investments being made in generative AI in the near term or will the real world applications really only start surfacing over the medium to longer term – after the initial wave of excitement has passed – as has been the case for most new tech frameworks in years past.

That said, there is a ton of opportunity for entrepreneurs to help lay the foundational elements for AI applications to go mainstream, regardless of the ultimate timing that it does so.

In particular, I’ll be paying attention to innovation in areas like AI model versioning and deployment, privacy and security around the data being leveraged to drive AI models, and AI ethical and regulatory monitoring software.

3. What would you recommend to founders that are trying to raise capital in this environment?

Claude De Jocas: The first piece of advice I would give to founders – especially those looking to raise capital in this environment – is to be selective about the type of investors you are reaching out to. Try to think about the messiest part of your business and reach out in a dedicated way to investors that have already internalized that risk and guided companies through similar waters. For example, if you have a low gross margin business, make sure to reach out to investors with a proven track record of investing in low-margin businesses.

I also think it is important to recognize that there is a big difference between investors saying that they have a thesis in a certain area versus actually making an investment in that space and being knowledgeable about it, especially if it is a more contrarian category. Until investors have gone through the process of investing in a similar company, serving on its board, and weathering good times and bad, their willingness to do deals in that sector is unproven.

Fundraising is time-consuming enough, and I would encourage founders in this market to get even more disciplined about only engaging with funds who have proven they will be able to get over the finish line. A fund’s existing portfolio is generally the strongest indication of where they have been able to build conviction.

Dave Gordon: There is no question that the macroeconomic environment has become more complex. At the same time, founders need to remember that while external factors like market conditions and available capital are important, focusing on the fundamentals and building a great business should be the primary goal.

My advice to founders would be to focus on controlling what you can. Hone your product or service, understand your customer’s needs more deeply, and go that extra mile to deliver value. By building a strong foundation and demonstrating growth potential, you’ll increase your chances of attracting capital regardless of market cycles.

Jim Ferry: My main piece of advice aligns with my earlier point: founders should ensure that if they do have debt, they are able to service it. The refi market is really tough right now and you should not assume that re-financing will be an option. The best thing you can do is cut expenses to show that your company can reach break-even to profitable. This will increase your chances of a successful financing in this market environment to be able to service the principal payments.

One other anecdote would be that if you need to do a RIF (Reductions in Force), it is better to do it all at once than a death by 1,000 cuts. While this is a difficult decision, it can be worse for company morale where employees are looking over their shoulder for more cuts in the future.

Melanie Jordan: I think founders should understand that firms are eager to deploy capital to great companies. A lot of firms had slow years in 2022. Volition has been at a great pace in 2023 including four new logo investments, but a lot of firms are still having slower periods.

With this in mind, the question founders should be asking themselves is how much they should actually be looking to raise. It is not about the flashy $100 million raise that gets you covered in all of the big publications, but rather, raising the amount of capital that makes sense for your business. What amount of money will help you go to market faster, beat out the competition, and further develop your product roadmap?

So my advice would be: One, just because markets are slow doesn’t mean there isn’t growth equity available. Two, really focus on what you will do with the capital and how you will deploy it responsibly.

-The Volition Press

MARKET PERSPECTIVE

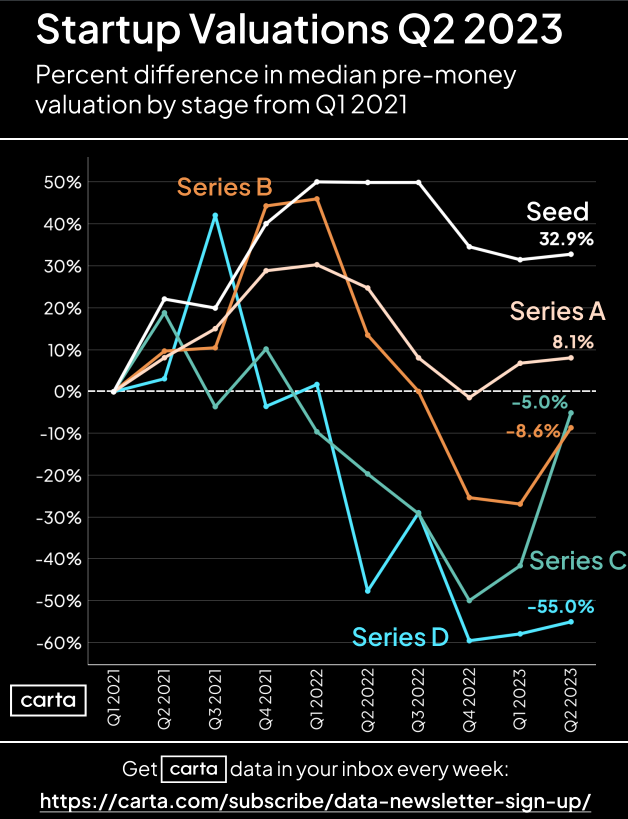

A Valuation Bounce Back?

Key Takeaways:

- Median pre-money valuations rose in Q2 across every stage from seed to Series D

- Series C saw the strongest recovery out of any stage from just under -40% to -5%

- Seed round media valuations are 33% higher than Q1 ’21 levels

Link: Click Here (Peter Walker)

THREADS, MUST-READS, AND KEY STATS

Commoditizing Market, Cyber Security, Meta’s Threads

Key Tweets:

- A Commoditizing Market (@larryvc)

- Microsoft and Cybersecurity (@TSOH_Investing)

- 15 Visuals Every Investor Should Memorize (@BrianFeroldi)

Must Reads:

- The True Impact of Concentration and Cascading Risk (Black Kite)

- Checking in on Crypto’s Most Promising Startups (The Information)

- The risks of AI are real but manageable (Bill Gates)

Key Stats:

- Tech Talent’s Preferred Work Preferences (hackajob)

- Q2 Tech Layoffs (Beth Kindig)

- Threads Reaches 100M Users (Rex Woodbury)

PORTFOLIO NEWS

Creatio, hackajob, SnapAttack, Super73

- Creatio Moves Into Beautiful New Office (Patrick Mahoney)

- hackajob CEO Mark Chaffey Featured in Article on Digital Life in 2035 (Forbes)

- SnapAttack: Cybersecurity Startups to Watch for in 2023 (CSO Online)

- Super73 Launches First Kid’s Bike “K1D” (Micael Cannavo)

PORTFOLIO FUN

Doing Things Media Launches “The Audio Game”

In partnership with Wilder, Doing Things Media announced the launch of “The Audio Game,” a party game that brings pop culture’s audio clips to life through QR coded cards.

You can read the full press release including details on the game using the link here.

Thanks for the read! We would love to hear what you think, so feel free to send us an email if you would like to chat.

-The Volition Team