Larry Cheng, Managing Partner

Despite many strong economic indicators such as record stock prices and low unemployment, there is a growing concern about a possible recession after an unprecedented 11-year bull market run in the public markets. According to the National Bureau of Economics, 3 out of 4 economists expect a recession by 2021. Over 66% of US CFOs expect a recession by Q121, based on a survey conducted by CFO Magazine. This raises the question: If a recession were to occur, what might it look like?

To answer that question, it’s helpful to look back at what actually transpired during the biggest recessions of the past 20 years: the Dot-com bust and the Great Recession. Whether you lived through those recessions or not, it can be easy to forget what exactly transpired. For that reason, I’d like to outline what happened during those recessions as a barometer of what we could potentially expect if another recession were to arrive. I’ll focus mainly on how the recession impacted emerging technology companies given that’s the core focus for Volition.

The Dot-Com Recession – 1999 – 2002

Let’s start our look back with the dot-com bust, which occurred around the time of the new millennium. It was a heady era in the market with Internet-fueled companies playing by new rules and dazzling Wall Street investors. These companies were growing quickly and marketing like crazy to sustain that growth. Case in point, 14 dot-com companies ran ads during the NFL Super Bowl telecast in January 2000, paying an average of $2 million-plus per spot.

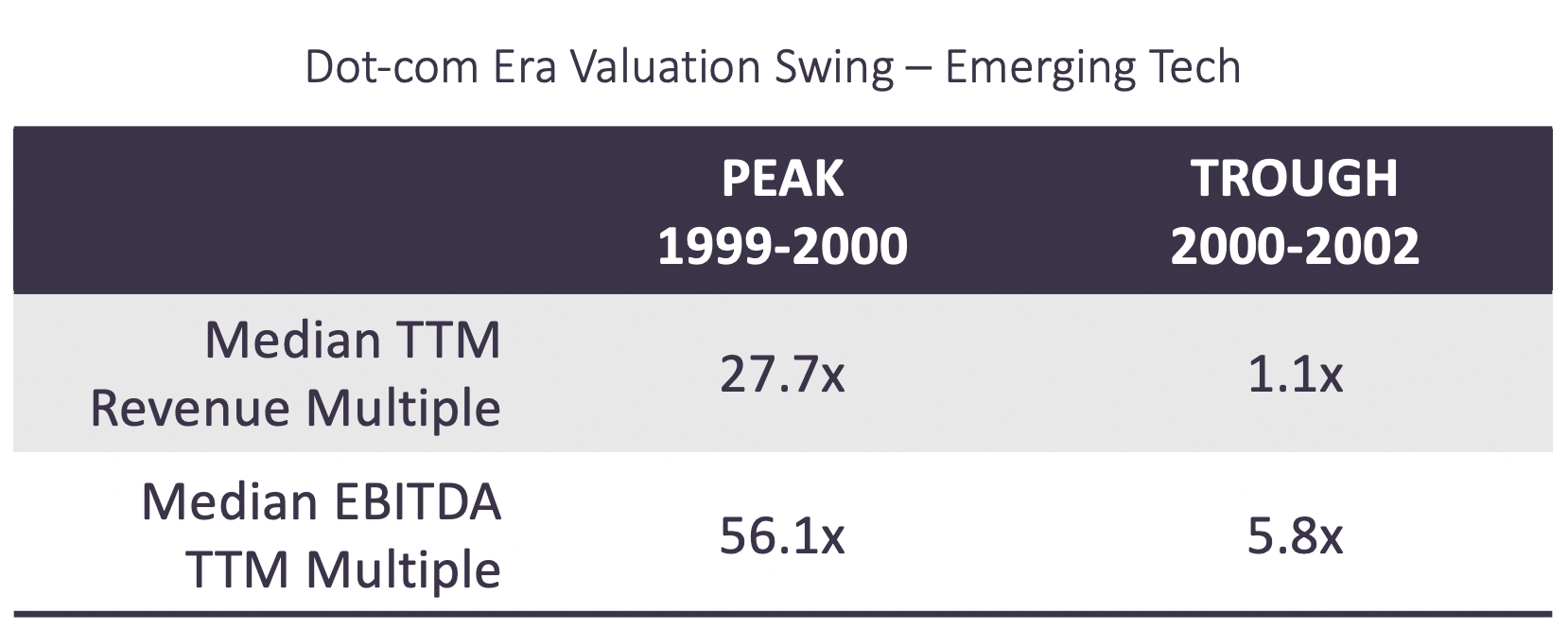

Looking at the numbers, these tech companies had every reason to be bold. In the Emerging Tech sector during the peak years of 1999 and 2000, median trailing twelve-month (TTM) revenue multiples were 27.7x. Similarly, median TTM EBITDA multiples for that sector were 56.1x during those peak years.

Respectable analysts were boldly predicting more of the same kind of performance from such companies. In April 2000, here’s how RBS Strategy framed its valuation of Juniper Networks by reporting: “Our initial price target of $330 reflects 157x sales. This valuation is based on: (1) Juniper is in the rapid growth phase of its business cycle, so an earnings multiple would not be realistic to use and (2) Early market advantage and large growth potential of its addressable market support a high premium valuation.” A month earlier, CIBC had justified its valuation of Amdocs using this phrase: “It is reasonable that these shares could trade at least 17X our calendar 2001 revenue estimate.”

But, here’s the reality: Barely two years later, Juniper’s enterprise value had dropped 98% – from its peak valuation to its trough – and Amdocs’ value had dropped 96%.

More broadly, by the time the Emerging Tech sector reached bottom (between 2000 to 2002), median TTM revenue market multiples had plummeted to 1.1x from the earlier 27.7x. EBITDA multiples at the trough were about 5.8x – a drop of 90% from the peak of 56.1x only a few years earlier.

This freefall wasn’t exclusively felt by smaller start-up tech companies. Market capitalization for major tech players such as Cisco dropped 89% and Intel dropped 82% from peak to trough. And there was plenty of pain in the consumer products sector, with blue-chip companies like Procter and Gamble and Nike losing more than 40% of their market capitalization during the market decline.

The Great Recession – 2006 – 2009

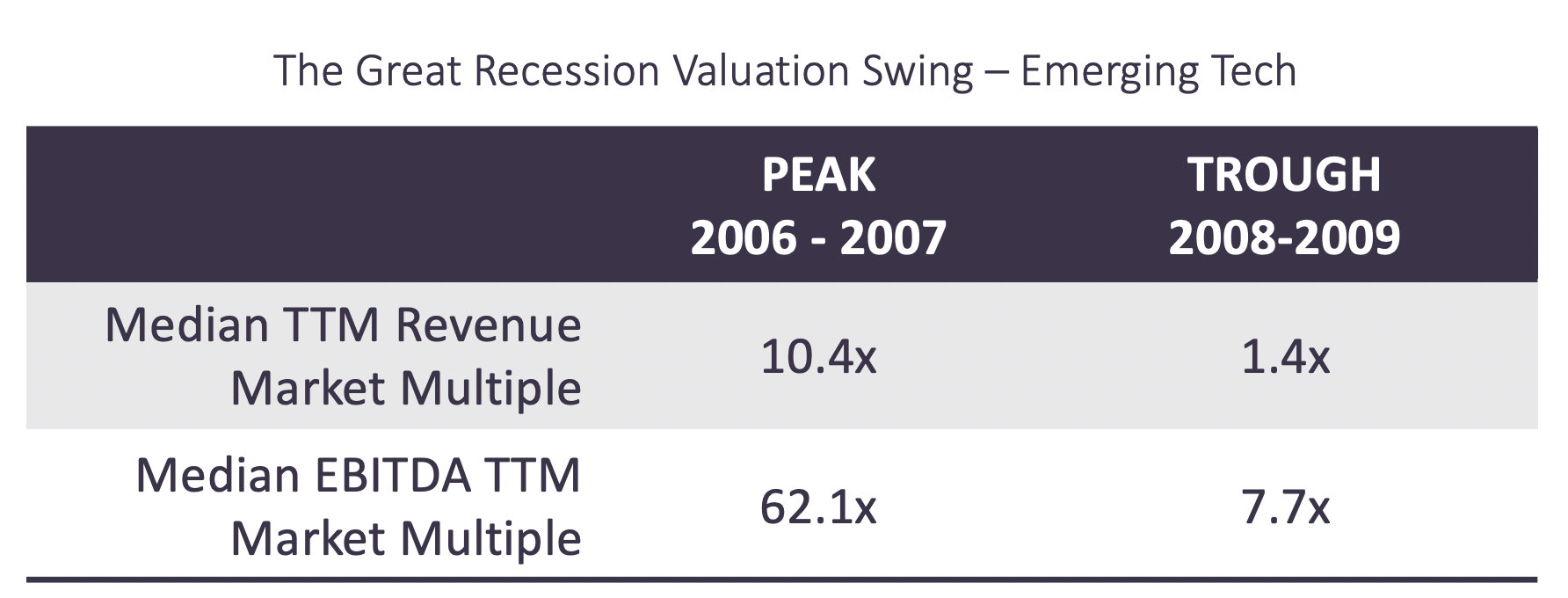

Memories are short in the investment world. That’s why, a mere five years after the dot-com bust, Emerging Tech was again a leading sector for speculation and rising multiples. During the peak years of 2006 and 2007, median TTM revenue multiples in the sector were 10.4x. This was well below the dizzying multiples (27.7x) of the dot-com peak, but still well above all historical norms.

Many analysts during the peak years before the Great Recession were bullish in their predictions of continued rising valuations in the sector. (Are you sensing a pattern?) For example, in August 2007, The Benchmark Company assessed the value of VMware by saying: “We believe investors should also consider EV/Revenue multiples. Today, VMware trades for 14.8x our 2007 revenue estimate of $1.27 billion.” Roughly a year later, Pacific Growth Equities had this to say about Salesforce: “The enterprise value/sales multiple of 7.2X is based on our 2006 revenue estimate of $491M.”

As in the dot-com era, these bullish valuations had hit a fence within a few years, with VMware’s enterprise value dropping 88% and Salesforce’s value dropping 71%.

Looking across the Emerging Tech sector, the recession delivered major setbacks in the 2008-2009 period. Median TTM revenue multiples plunged nearly 90%, down to 1.4x from the 10.4x of a few years earlier. Median TTM EBITDA multiples at the bottom represented a similar freefall, down to 7.7x from the peak of 62.1x only a few years earlier.

The Great Recession took its toll on the market caps of tech giants (Cisco down 60%, IBM down 40%) and consumer products giants as well (P&G and Nike were both down about 40%), much like they experienced during the dot-com bust.

What do these two recessions tell us about today’s valuations?

Now that we’ve looked at the two recent recessions side by side, we can see that the market conditions that precipitated each were similar in some ways but different in others. So, let’s bear that in mind as I make a few observations about today’s Emerging Tech valuations and the related market chatter.

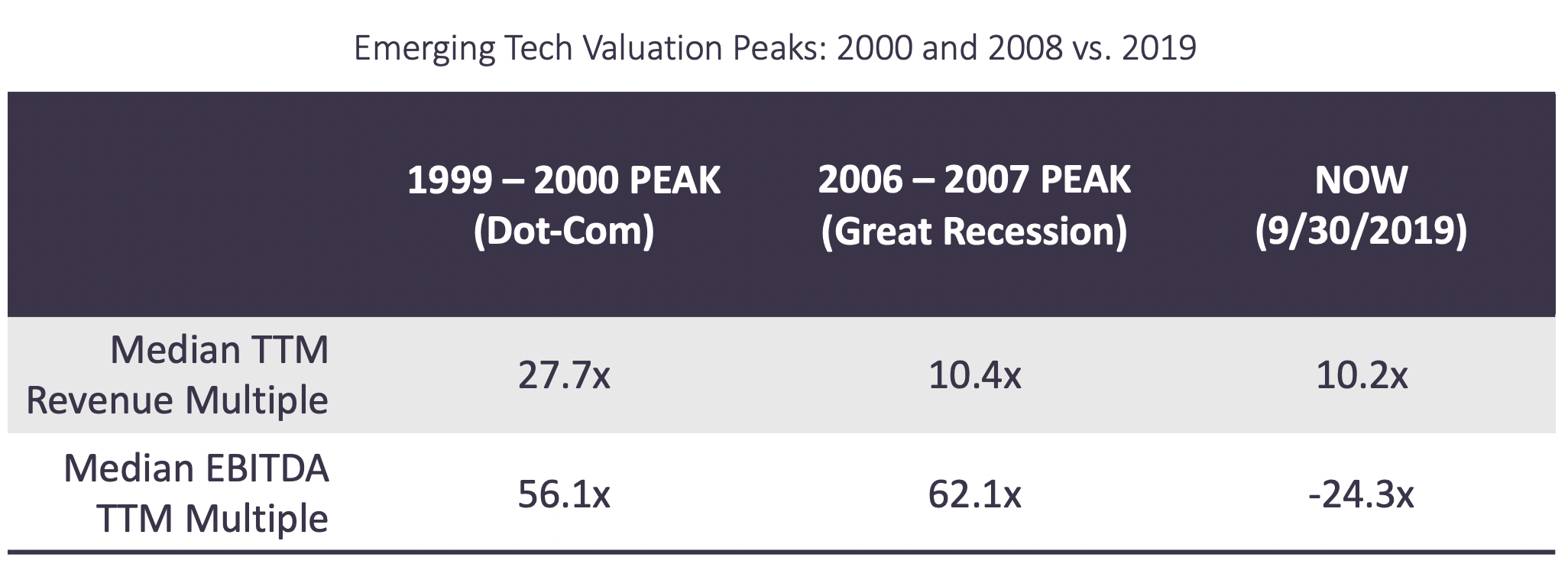

As shown in the chart, revenues right now are tracking closely with those experienced just before the onset of the Great Recession. But, when you stretch that comparison to account for profitability, the alignment breaks down. Median EBITDA at the 2006-2007 peak was 62.1x – versus today’s minus 24.3. This demonstrates that the profitability profile of today’s companies is worse than in either of the prior two recessions.

Much like in prior recessions, many analysts who are sizing up today’s market movers are employing the bullish language of their predecessors in earlier decades. Here are two recent comments:

- “Is valuation even relevant today? Probably not. With BYND trading at ~30.0x NTM revenue, the market sees considerable upside.” DA Davison, about Beyond Meat (Sept. 2019)

- “Our bullish stance at ~20x revenue is driven by…superior technology…hypergrowth.” SunTrust, about CrowdStrike (July 2019)

Are we in for another 80%-90% peak to trough decline in stock prices if/when the current bull market comes to a conclusion? Will today’s 10x-20x revenue multiples become tomorrow’s 1-2x revenue multiples? Will today’s $1 billion company become tomorrow’s $100 million company? That may seem unfathomable to many, but that’s exactly what happened in prior recessions not just at an isolated, company level but at a sector level in tech. That’s the magnitude of how sentiment and valuations can change in a relatively brief period of time.

It’s important to note, though, that after both recessions the markets didn’t settle in at the trough, but settled in higher. It’s true that some companies never recovered, but many others made comebacks to become great brands (e.g., Salesforce and VMware, whose Great Recession losses were noted above). Recessions also create space for new market entrants and give investors more room than when the market is so hot.

Whether we will experience another recession like the past two – only time will tell. But surely, briefly looking back at the past recessions should help us be grounded and prudent as we enter our 11th consecutive year of bull market conditions.

Right now, owners of emerging tech companies may want to consider this question: What should I be doing now to ensure that my company could weather another recession – whenever that might occur?

That’s a question I will try to tackle in my next post.

Connect with Larry