Capital+ Supply Chain

Supply chain is a critical component and serves as the backbone of global commerce. This industry presents a large opportunity for disruption. We look to partner with vendors that enable supply chain digitization, visibility, and resiliency.

The global logistics and supply chain market is an $11 trillion industry, representing 12% of the world’s GDP. The last few years have exposed supply chain vulnerability and antiquity, putting increasing pressure on companies to invest in their supply chain and logistics capabilities. As new technologies emerge, we are excited to leverage our expertise in supply chain technology to partner with founders to solve some of the market’s biggest pain points.

The Supply Chain market is large and presents a significant opportunity for disruption, with opportunities for both SaaS and tech-enabled services. This market demonstrates an incredible opportunity for virality, as companies are able to target one-to-many sales and penetrate an entire supplier network. Companies that we see succeed are those that either focus on a specific step of the supply chain or provide full supply chain visibility for a specific vertical. For example, Volition portfolio companies Tracelink and Assent are both very verticalized supply chain visibility, traceability, and compliance solutions.

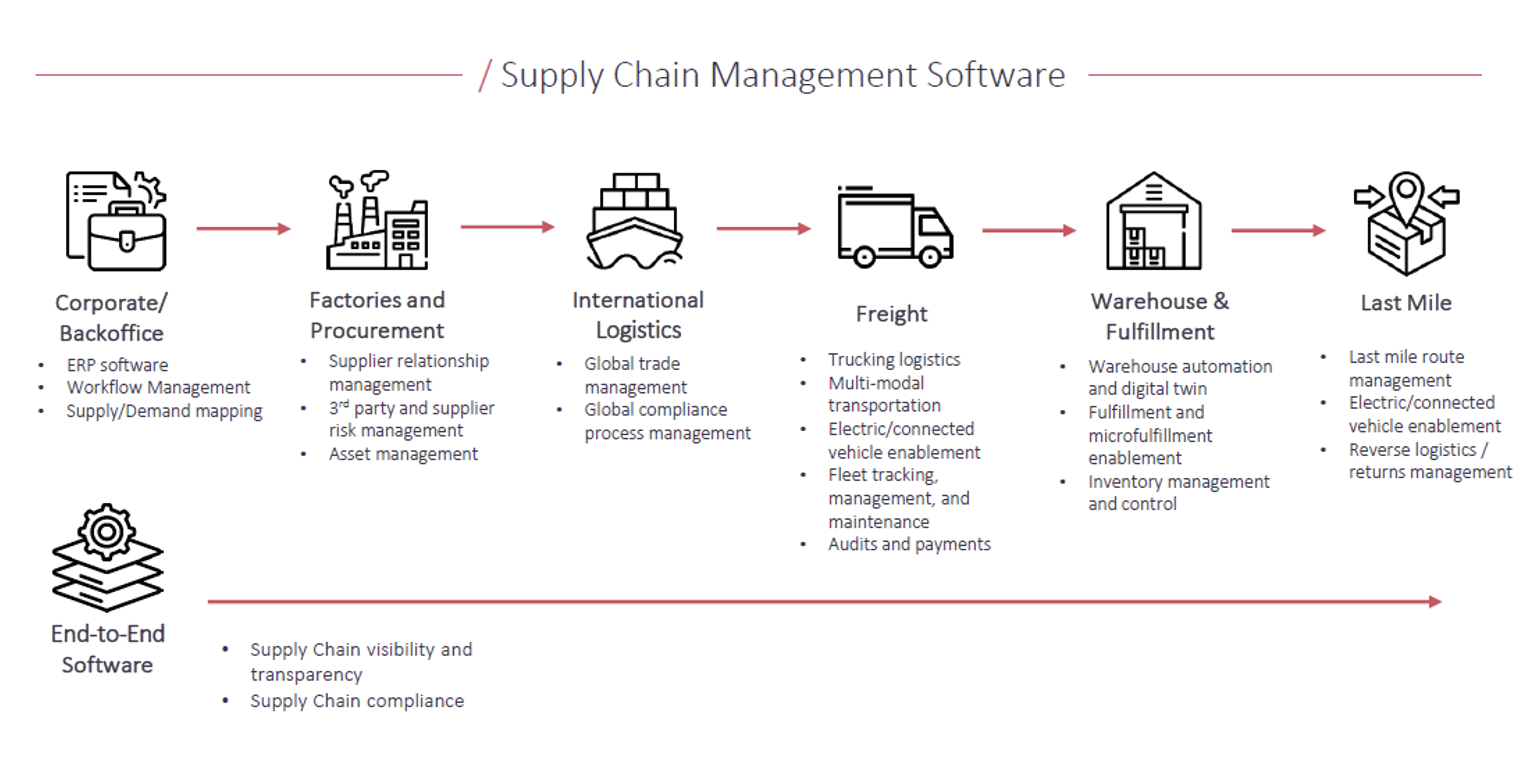

Some of our areas of focus are listed below, but we are excited to meet founders tackling all aspects of the supply chain ecosystem.

We believe that a real perspective on supply chain technology requires a viewpoint on both the enterprise and consumer experiences. As investors in both B2B supply chain technology companies and B2C companies that leverage robust supply chains, Volition brings a unique perspective to this market. We are excited to leverage this experience in partnering with emerging leaders in supply chain technology.

Amazon has fundamentally changed consumer shipping speed expectations. In 2017, shipping speeds of 3-5 business days were…

The marketplace model has resulted in high delivery fees, lack of efficiency, and a customer experience highly dependent on…