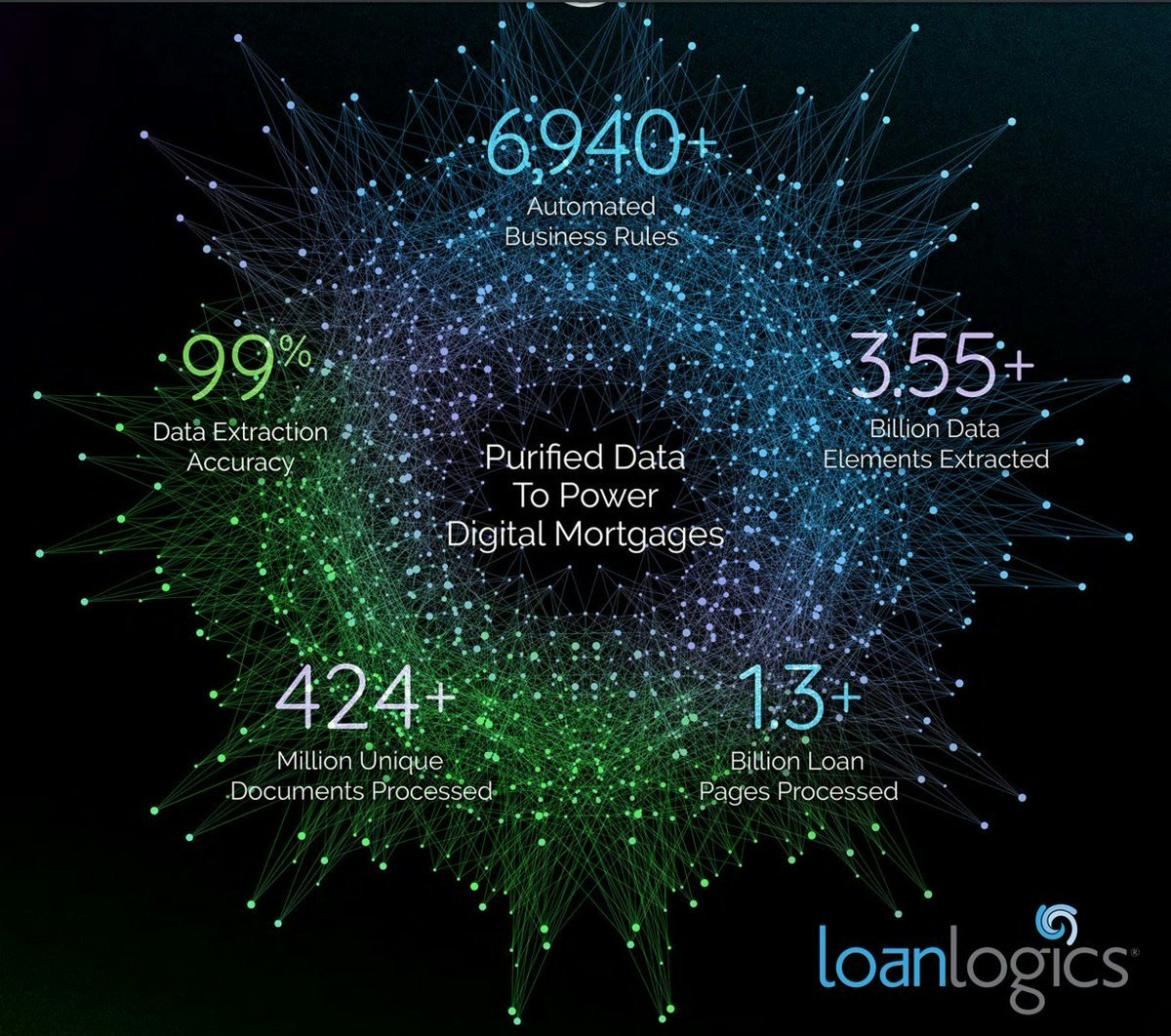

LoanLogics provides technology that improves the transparency and accuracy of the mortgage process and improves the quality of loans. The Company serves the needs of residential mortgage lenders, servicers, insurers, and investors that want to improve loan quality, performance and reliability throughout the loan lifecycle by helping clients validate compliance, improve profitability, and manage risk during the manufacture, sale and servicing of loan assets.

ABOUT

BACKGROUND

In May 2013, LoanLogics formed upon the merger of two companies, NYLX and Aklero Risk Analytics. The stakeholders of both teams identified the opportunity to come together to provide an automated, end-to-end solution to a market that was in need of technology and innovation. They were ready to merge and were looking for a capital partner to help fuel the growth of the newly formed company.

Later that year, Volition Capital invested in LoanLogics.

WHY WE INVESTED

The combination of the high volume of new loans in the mortgage industry with the increasing focus on the quality of loan documentation presents a significant market opportunity for LoanLogics. The company has a compelling value proposition with its holistic loan quality platform that automates manual processes throughout the entire lifecycle of a loan for many participants in the mortgage ecosystem.

Volition Capital Managing Partner, Roger Hurwitz, notes, “The mortgage industry is under unprecedented regulatory and market pressures to improve loan quality, reduce risk, and formally track loan quality metrics at various stages of the life of the loan. Firms of every shape and size are struggling to meet the demands of the challenging new environment and LoanLogics is in a favorable position to displace legacy, niche technology, and people-intensive service providers.”

NEWS & INSIGHTS

-

AUGUST 15, 2019 Industry leader in loan quality technology supports GSE’s FAST... more

-

Pictured: Volition Capital Managing Partner Roger Hurwitz At Volition, we’ve... more

-

Pictured: John Bradford, PetScreening CEO Volition Press: John, thank you so much... more

-

ButterflyMX Secures $50 Million in Series D Funding Led by JMI Equity Investment... more

-

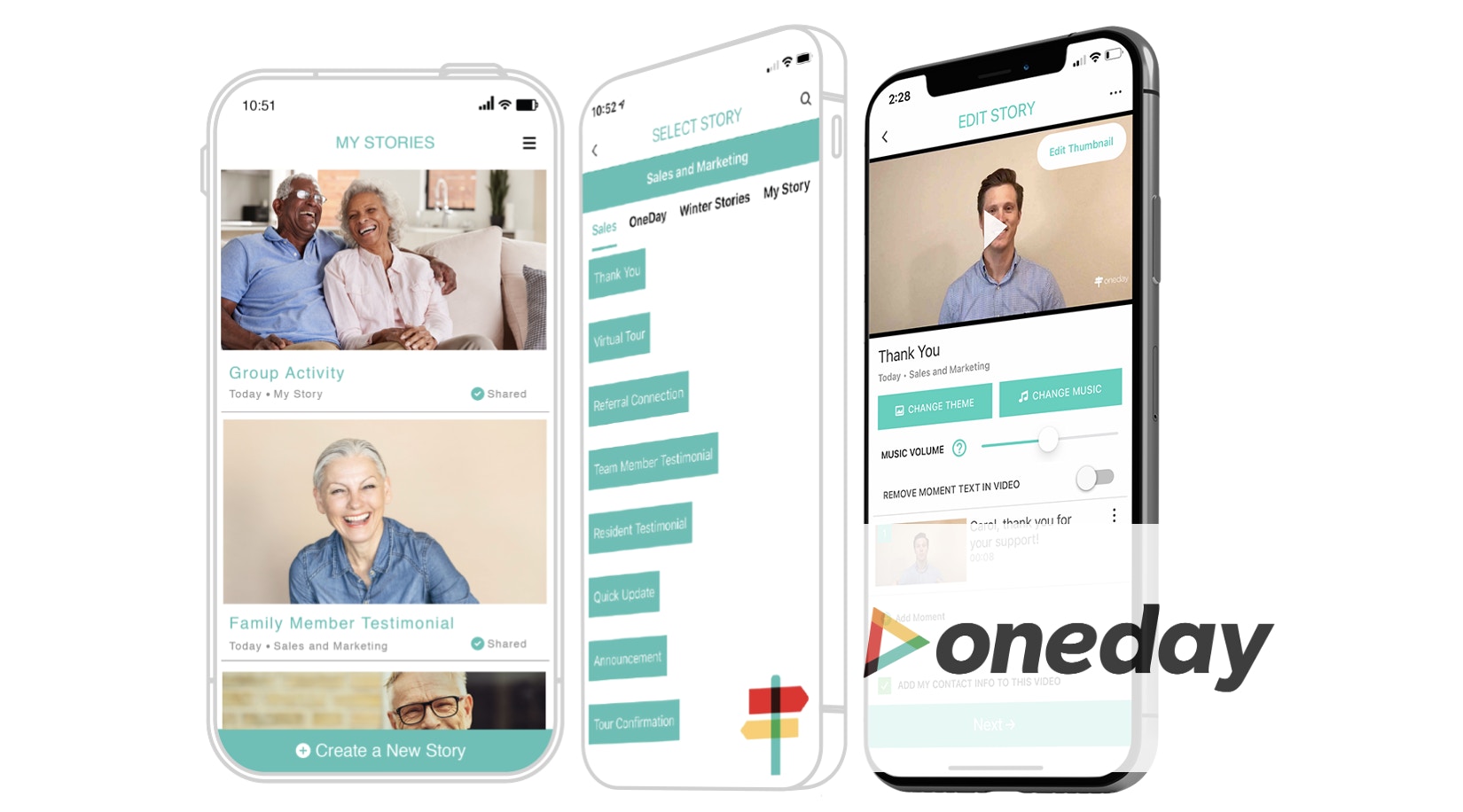

We’re excited to announce our investment in OneDay, the real estate industry’s... more

-

The round builds on OneDay’s accelerated momentum over the past 18 months,... more

-

By Austin Goltz The low interest rate environment continues to drive growth in the... more

-

Volition Capital has a selective investment approach that sees us partner with just... more