It is our experience that some of the most passionate founders in the Volition portfolio are building in the healthcare industry. Whether motivated by their experiences as a healthcare clinician, by a profound medical event that directly impacted their family, or simply by observing the deep fractures in our current healthcare system, we’ve found that healthcare entrepreneurs bring a unique sense of purpose and fortitude to their endeavors.

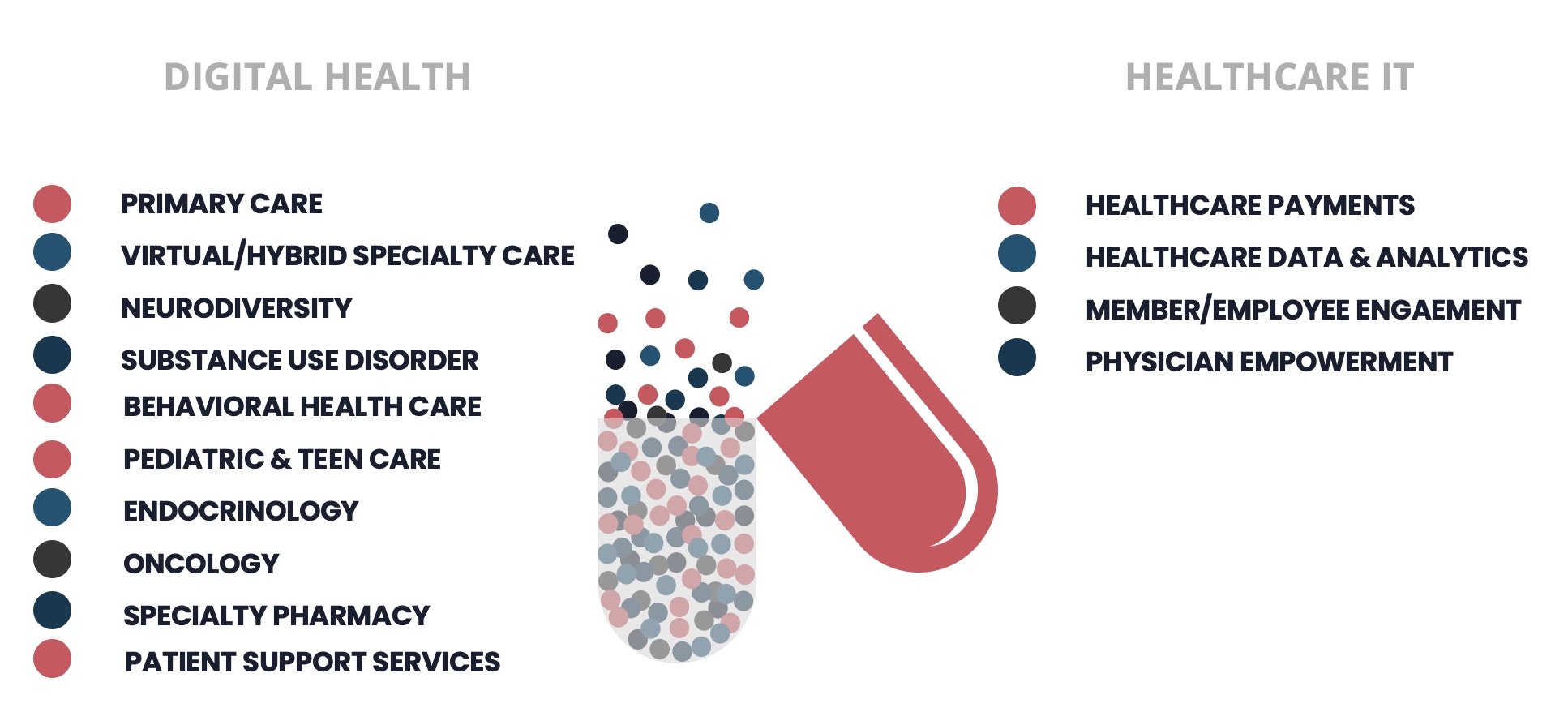

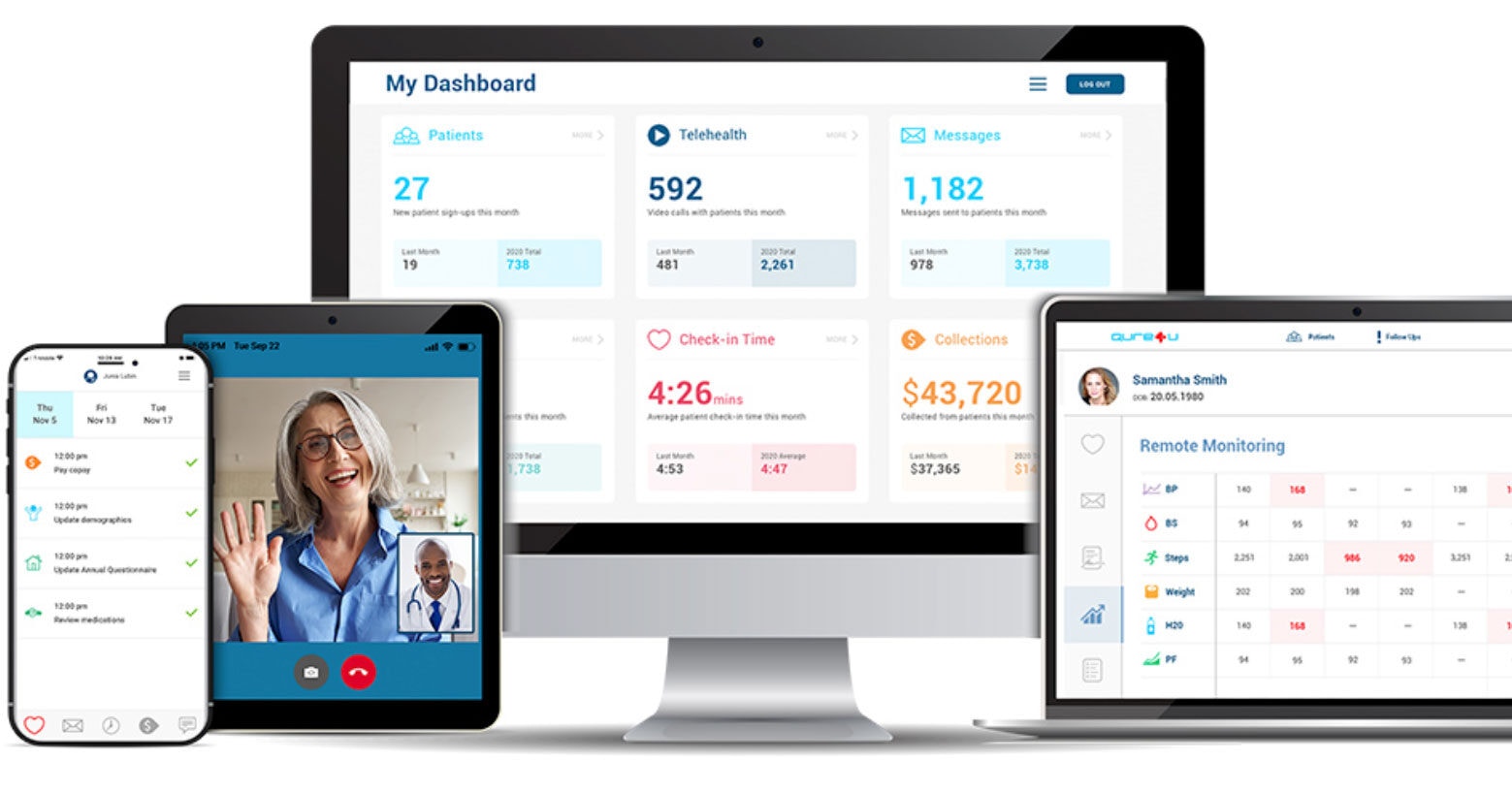

It is our privilege to partner with these founders, and our aim is to match the intensity with which they are effecting change in the industry. Our unique, dual focus on digital health and healthcare IT businesses has refined our viewpoint on the intersection of the patient and the provider experience. We are excited to continue investing in companies across all points of the enterprise-facing vs. patient-facing continuum.