Digital advertisers have been on a test-and-learn odyssey the past few years as they’ve adapted to emergent technology, shifts in consumer behavior, and impending changes to third-party data tracking. Despite these challenges, the ad tech market is booming – overall deal volume went up 82% from 2020-2021, and digital advertisers are projected to spend $240 billion this year alone.

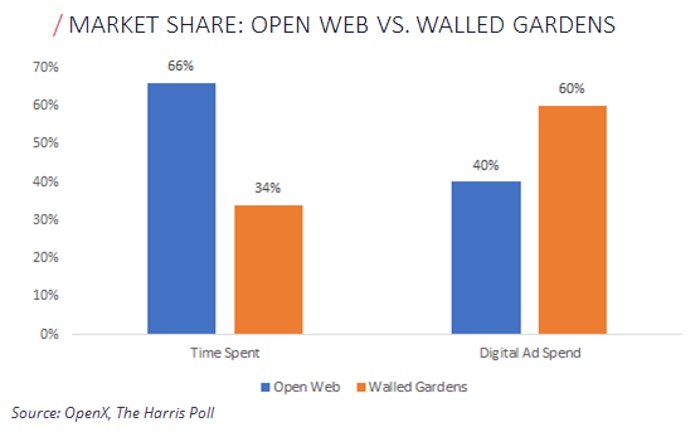

While there has been lots of money flowing into the vertical over the past couple of years, we have always held the contrarian view based on a commitment to understanding the complexities and history of the sector. The prevailing notion today is that the walled gardens of Google, Facebook, and Amazon will dominate the ad tech future, but there is an imbalance of time spent by consumers on the open web and the percentage of digital ad spend outside of the walled gardens. This creates an opportunity and we’re interested in digging deeper to unlock opportunities others might be overlooking.