Volition Capital invests in real estate technology and tech-enabled services businesses that are disrupting traditional methods of doing business in both residential and commercial real estate. We see much of the massive market in real estate as still untapped by technology, and we remain excited to continue partnering with entrepreneurs in proptech who have aspirations for greatness.

We’re seeing increasingly widespread digital adoption by players across the real estate value chain. Owners, brokerages, agents, buyers, and tenants are leveraging technology not only for internal management and reporting, but for tenant-facing experience management as well, making solutions more deeply integrated and mission-critical. The potential for more proptech companies to break out is high, and Volition remains focused on identifying the entrepreneurs and companies with the highest breakout potential.

Our prior experience backing founders of high-growth, capital-efficient real estate technology companies has shown us the ability of scrappy entrepreneurs to make an outsized impact in real estate.

We believe that COVID has accelerated certain trends within real estate that will only continue in a post-pandemic world, including the move toward further transparency/democratization of real estate data, strategic space utilization, increased focus on tenant experience, compliance-driven tech investment, real estate-specific customer acquisition tools, the leveraging of building/asset data, and more.

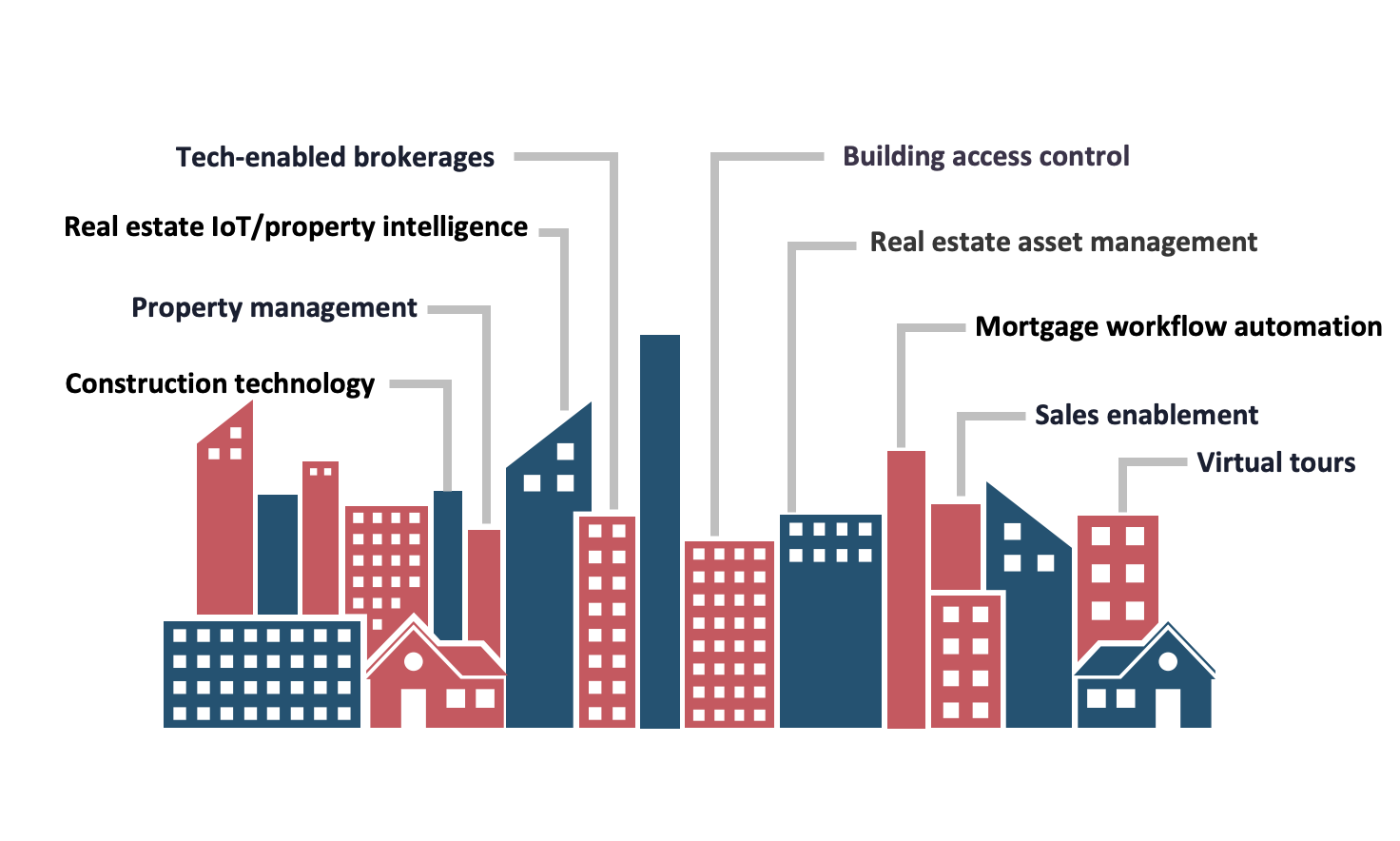

Some of our areas of focus within proptech include the following:

Volition brings a unique perspective to proptech given out experience in the space which spans sales enablement, property management, building access control, and vertical-specific solutions for industries like mortgage and self-storage.

When it comes to real estate, we see the ripeness as excellent. Not only is real estate worth $277 trillion -- making it…

For about as long as the Constitution has been law, building codes – regulations which specify the standards for…

The real estate industry has not historically been known for its speed and agility. From complex zoning laws that hinder…

The pandemic has highlighted the importance of space and employee experience. Pre-pandemic, the focus was on optimizing…

Last week, we announced a $35 million fundraising round for ButterflyMX that we led in conjunction with Egis Capital…

We’re excited to announce our investment in OneDay, the real estate industry’s leading video platform, enabling…

Buildings consume a tremendous amount of energy and account for 40% of the world’s total emissions. Green retrofitting -…

ButterflyMX, creator of smart video intercoms, package rooms, keypads, elevator controls, key lockers, and other access…

OneDay, a Texas-based software-as-a-service (SaaS) company that empowers businesses to drive revenue growth and customer…

The low interest rate environment continues to drive growth in the ~$10T U.S. mortgage industry. Mortgages are the largest…