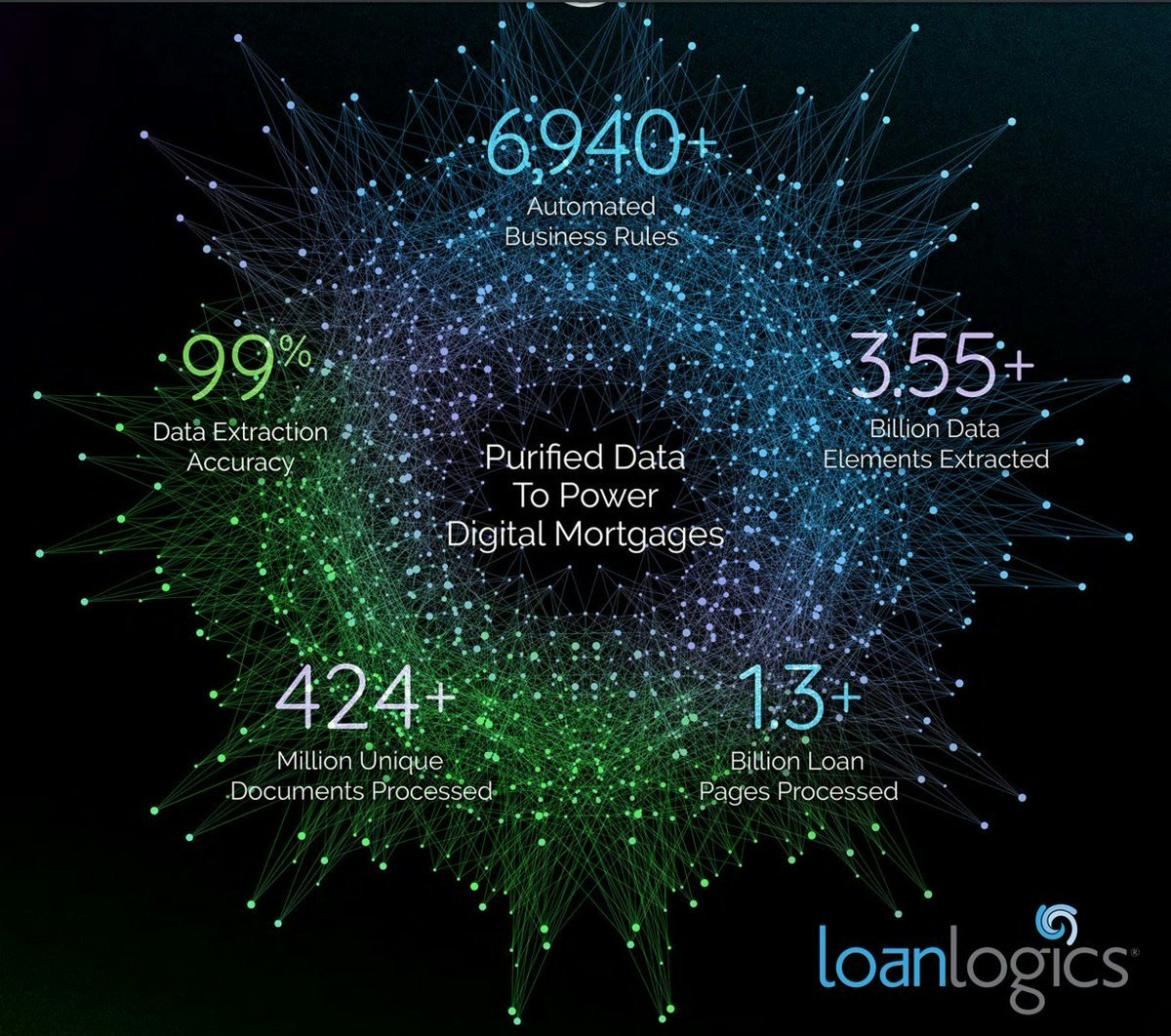

LoanLogics provides technology that improves the transparency and accuracy of the mortgage process and improves the quality of loans. The Company serves the needs of residential mortgage lenders, servicers, insurers, and investors that want to improve loan quality, performance and reliability throughout the loan lifecycle by helping clients validate compliance, improve profitability, and manage risk during the manufacture, sale and servicing of loan assets.

ABOUT

BACKGROUND

In May 2013, LoanLogics formed upon the merger of two companies, NYLX and Aklero Risk Analytics. The stakeholders of both teams identified the opportunity to come together to provide an automated, end-to-end solution to a market that was in need of technology and innovation. They were ready to merge and were looking for a capital partner to help fuel the growth of the newly formed company.

Later that year, Volition Capital invested in LoanLogics.

WHY WE INVESTED

The combination of the high volume of new loans in the mortgage industry with the increasing focus on the quality of loan documentation presents a significant market opportunity for LoanLogics. The company has a compelling value proposition with its holistic loan quality platform that automates manual processes throughout the entire lifecycle of a loan for many participants in the mortgage ecosystem.

Volition Capital Managing Partner, Roger Hurwitz, notes, “The mortgage industry is under unprecedented regulatory and market pressures to improve loan quality, reduce risk, and formally track loan quality metrics at various stages of the life of the loan. Firms of every shape and size are struggling to meet the demands of the challenging new environment and LoanLogics is in a favorable position to displace legacy, niche technology, and people-intensive service providers.”

NEWS & INSIGHTS

-

7/7/21Jacksonville, FL | July 7, 2021 - LoanLogics, a digital mortgage solutions... more

-

8/15/19AUGUST 15, 2019 Industry leader in loan quality technology supports GSE’s FAST... more

-

6/19/19Company seeks to expand its collateral assessment capabilities and offerings... more

-

4/18/19President & COO Bill Neville promoted to CEO LoanLogics, a recognized leader in... more

-

5/23/22Energy Codes and PropTech: The Future of Sustainability For about as long as the... more

-

5/23/22The Office of the Future: Commercial Real Estate Landlords Need Flex-space, But... more

-

4/5/22How green buildings are key to sustainability targets: The growing retrofitting... more

-

1/13/22The real estate industry has not historically been known for its speed and agility... more